Key Takeaways

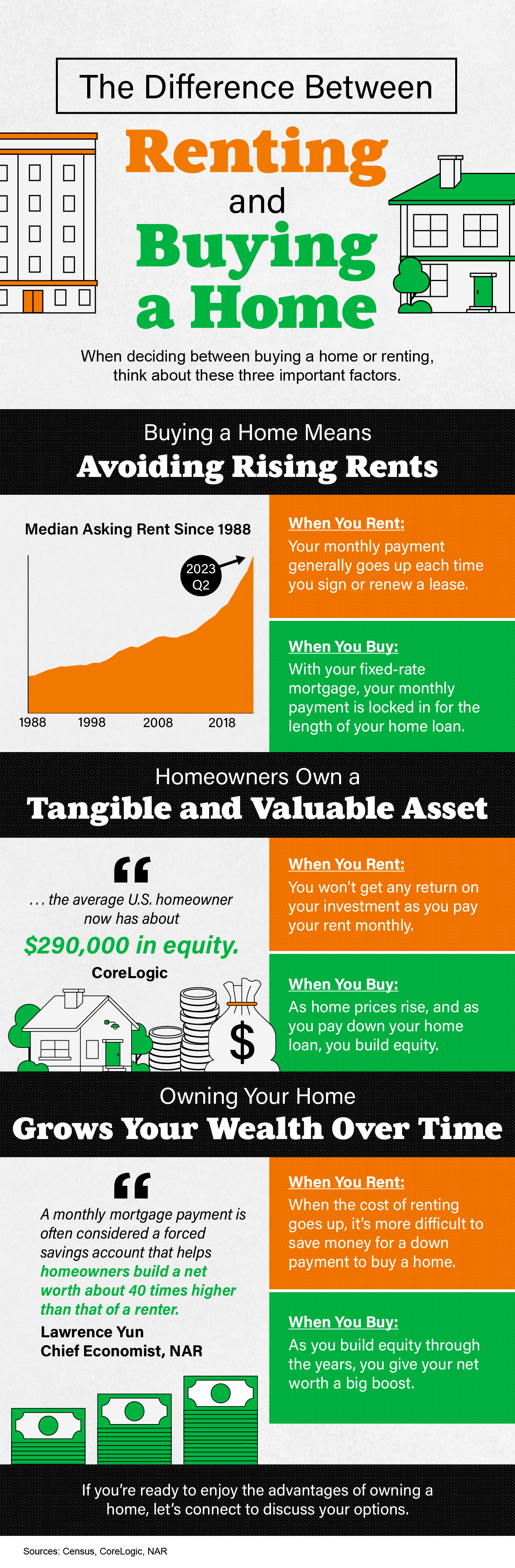

Consider these three critical factors when deciding between renting and buying a home.

- Buying a home means avoiding rising rents, owning a tangible and valuable asset, and growing wealth over time.

- If you’re ready to enjoy the advantages of owning a home, let’s connect to discuss your options.

Homeownership had much to do with that growth because there’s a significant net worth gap between homeowners and renters. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than a renter’s.”

As the chart above reflects, you do not receive a return on investment when renting. Additionally, when the cost of rent goes up, it is difficult to save money. However, when you buy as home prices rise and the loan is paid down, equity is built, improving net worth.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.