A Good Time To Make A Deal: New York Real Estate In Q1 2023

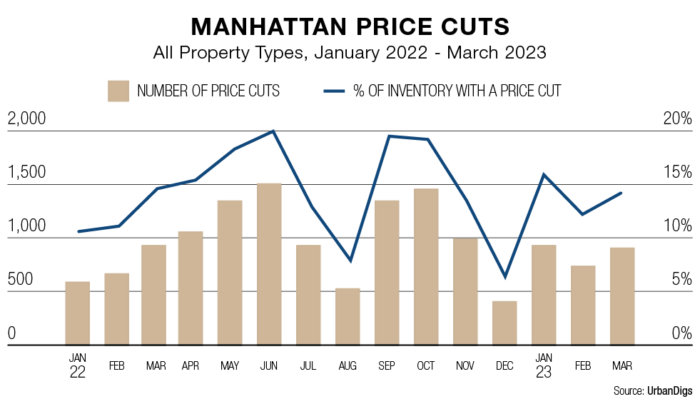

New York City’s real estate market reacted strongly to the economic uncertainty of 2023’s first quarter. Many buyers throughout our market put their plans on hold after the 50 basis point increase in the Fed rate during December (which followed several 75 basis point increases). Mortgage rates continued to rise. The stock market fell. Transaction volume, slipping throughout the second half of 2022, remained weak in January. Surprisingly, it began to strengthen in February and improved even more in March. The deals correlated strongly to price reductions or highly realistic listing prices. There has been no room for optimistic pricing in 2023.

The high-end market (homes at $10 million and over) has suffered disproportionately during this year of correction. Throughout the first two months of the year, few high-end listings sold, and those which did tend to have either unique qualities or the luck of the draw in finding that one buyer for whom the property was exactly what they wanted. Owners who bought since 2014 or 2015 have had to accept substantial losses on their properties to move them.

$4 million to 10 million dollar market

The story has somewhat differed in the $4 million to 10 million dollar market. The Olshan Luxury Market Report, which reports each week on contract activity at $4 million and above, jumped from an average of just above 16 deals per week in January to an average of 25 deals per week in February, then to an average of just under 32 per week for the first three weeks of March. Many luxurious properties of seven, eight, or nine rooms can still linger on the market for months. It’s all a question of price. Half the e-mails New York agents have received since January announce price reductions!

Probably the most active market in the city has been for lower-priced units, especially those priced at $2,500,000 and below. The rental market remains extremely strong, at its highest point in recent memory (although a bit weaker perhaps than it was six months ago.) These properties at $2 million and below are the ones for which the leverage between buying and renting tilts towards buying, especially on an after-tax basis. At this level, inventory remains tight.

Macro Market Effect

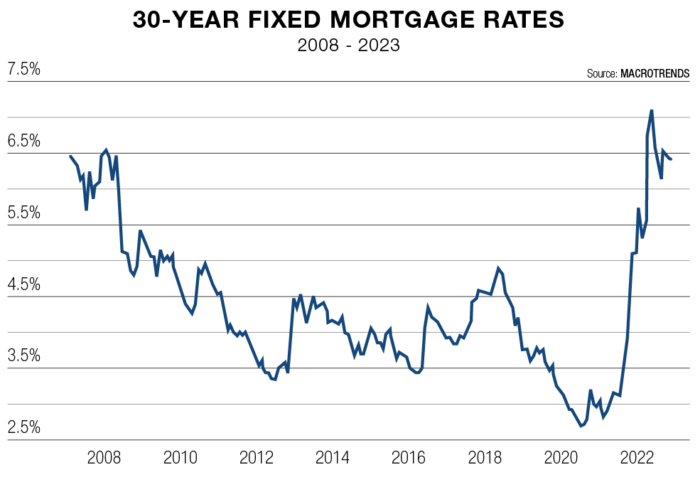

Despite the ripples of disruption caused by the collapse of Silicon Valley Bank and Signature Bank. The New York market has experienced increased activity with the approach of spring. The Fed’s decision to only raise its target rate by 25 basis points, a repeat of its decision in late January. It appears to signal an end to the far more significant increases which have increased the Fed rate from .25% to just under 5% in a year. At the same time, the correlation between the Fed rate and mortgage rates is imperfect (mortgage rates tend to be more influenced by the bond market). The enormous increase in the Fed rates has driven mortgage rates up precipitously, slowing buyer confidence as the monthly cost of purchases increases. Especially for younger buyers, the artificially low rates predominated since the 2008 recession seem the norm. In fact, a 5% or 6% mortgage remains low by historical standards. The gradual acceptance by buyers of this reality is a factor in allowing the real estate market to begin to recover.

Multiple factors make reading the tea leaves about what’s coming in the second quarter difficult. The fate of regional banks remains precarious. While the absorption of Credit Suisse by UBS signals that this bank crisis is not merely an American phenomenon. At the same time, inventory remains tight in many sectors of the New York market. Even wary buyers find that they often cannot find much inventory to choose from. Stock market volatility may well remain with us, like inflation, even as both hopefully cool over the balance of the year. But the big price decreases seem behind us, and property costs have plateaued.

It’s an excellent time to make a deal!