Manhattan Market Report for the week ending December 9th, Supply closed out at 6,747. Pending Sales at 2,473 and off-market listings maintain the market pulse at a .37% level. During the December holiday month, larger amounts of listings are removed from the market to refresh the listing and avoid accumulating days on market.

The Federal Reserve is expected to raise interest rates by a smaller half percentage point as inflation has started to slow, but continues to hover near four-decade highs. Many economists are predicting that inflation will continue to fall as supply chain issues clear, and consumers are shifting from good to services spending.

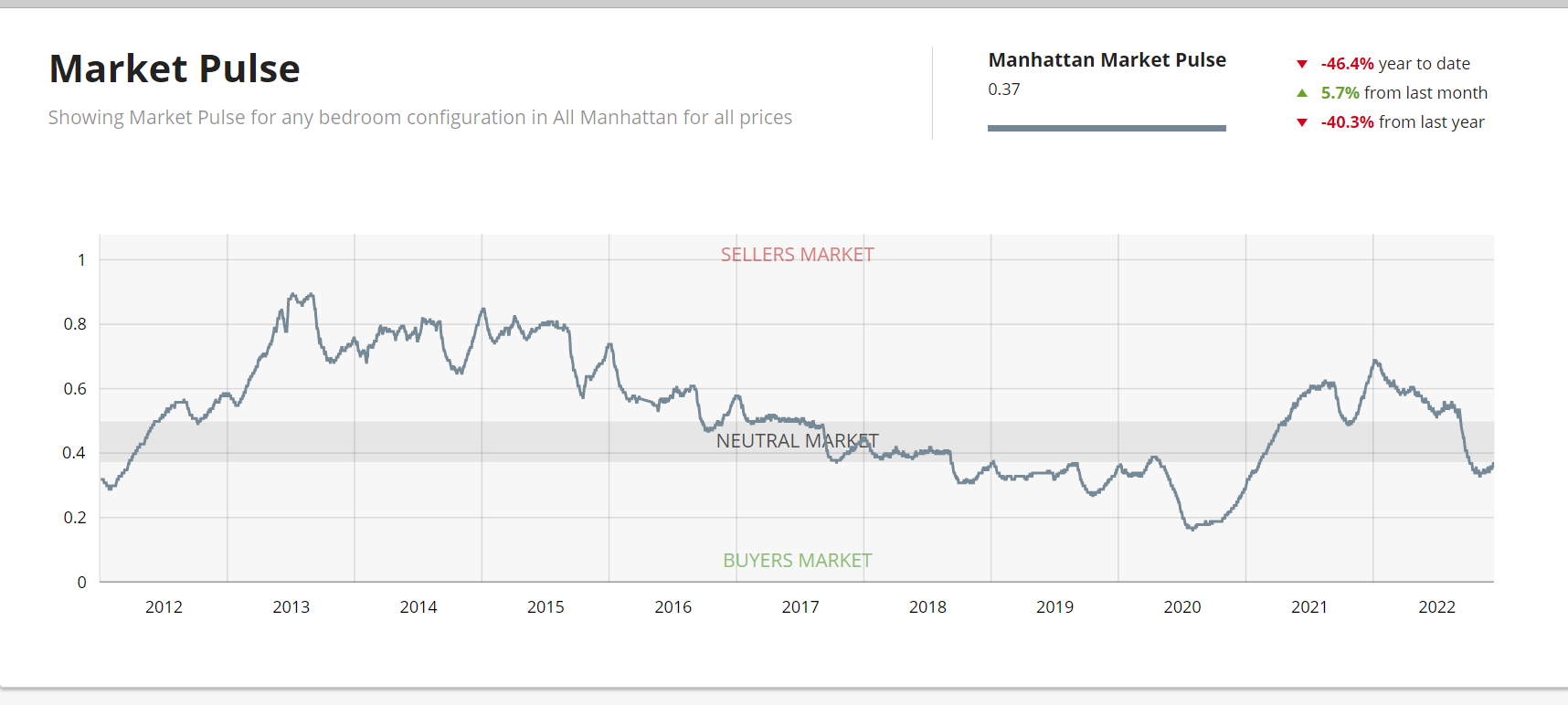

Market Pulse

The market pulse measures the ratio of supply and demand seems to continue to evidence the beginning of the buy-side leverage peaking. UrbanDigs reports “a bottom formation tends to occur when a decelerating market starts to show signs of a positive

turnaround. This reshapes the downward slope to a flatter one, and sometimes, but not always, precedes a period of recovery. The bottom formation is circled in the chart below, as well as the Covid bottom signal and arrows of past signals.”

The weekly supply as seasonally expected is down and stands at 176. The weekly contract signed is down too and stands at “155”. Off Market is 387 listings. Market Pulse resides at .37%.

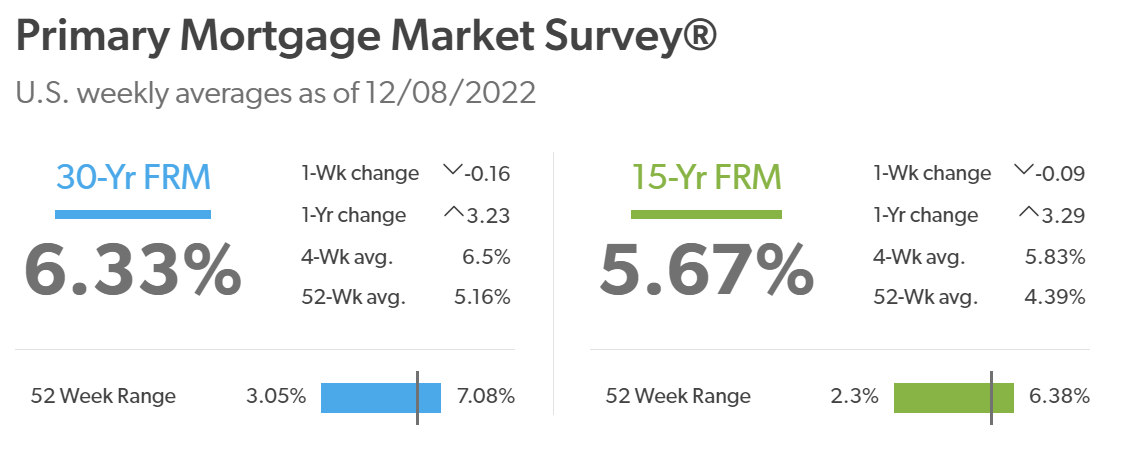

Mortgage Rates Continue to Drop

Freddie Mac reports mortgage rates decreased for the fourth consecutive week, due to increasing concerns over lackluster economic growth. Over the last four weeks, mortgage rates have declined three-quarters of a point, the largest decline since 2008. While the decline in rates has been large, homebuyer sentiment remains low with no major positive reaction in purchase demand to these lower rates. If rates continue to drop, buyers may feel encouraged to purchase.

Monthly Contract Activity

Monthly Contract Activity resides at 856 (blue bar) trends below the historical averages (gold bar) and are in a range-bound market path. This path is classified as horizontal, ranging, or sideways bound between a high and low range. The monthly Contract Activity range is dependent on “rate volatility, the Fed, risk assets, credit spread, and other macro indicators”.

Curious to find out your buying power in this market contact me to discuss your plans. I am ever so grateful for the growing number of people that are choosing and recommending Coldwell Banker Warburg as their number-one team.

A new year brings new beginnings and fresh energy. As I begin to prepare for 2023 I would like to hear from you to learn what I can do differently to serve those that are planning to buy. How can I make those who are planning to sell feel more comfortable in this environment? There are opportunities in the market and together we can make the future brighter.

Other educational articles about the market and your home search are under Karen’s Blog.

Read the full New York Post article here.