Manhattan Market Report for the week ending May 12, 2023, Supply closed out at 7,426. Pace appears to be slowing. Pending Sales increase and sit at 3,044 (1 1/2% increase), outpacing the 2019 vintage year; off-market listings (delisting) maintain the market pulse at a .41% level. We are in a balanced market. Leverage does not favor buyers or sellers. Urbandigs reports “that the more recent deal volume in Manhattan appears to be putting slight upward pressure n overall liquidity – a healthy sign as the market nears the end of the spring season.”

“The wise young person or wage earner of today invests his money in real estate.” – Andrew Carnegie.

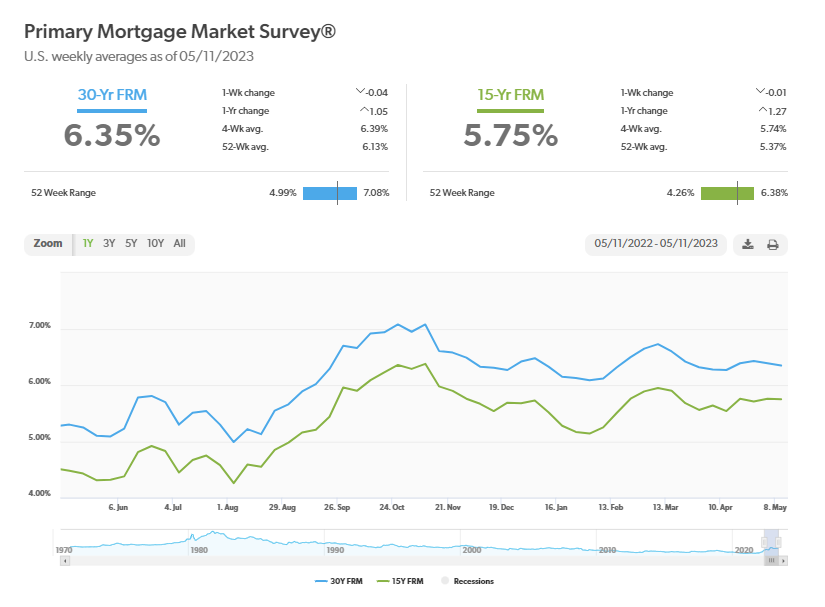

Mortgage Rates Inch Down

This week’s decrease continues a recent sideways trend in mortgage rates, which is a welcome departure from the record increases of last year. While inflation remains elevated, its growth rate has moderated and is expected to decelerate over the remainder of 2023. This should bode well for the trajectory of mortgage rates over the long term. – Freddie Mac (May 11th)

The Report

Additionally, “With affluent individuals from overseas stepping back into the game to purchase their dream property, the Coldwell Banker Global Luxury program fielded a new survey to explore the trends and attitudes of the wealthy international consumer. Polling more than 1,200 high-net-worth consumers from 12 countries on their dreams and sentiments of buying U.S. real estate, paired with our annual luxury real estate outlook.”

Furthermore, “The number of global millionaires is at its highest point in history. By 2026, it is estimated that the number of millionaires worldwide will surge by 40%, and one in seven adults will have a net worth of at least $1 million”; “The Report.”

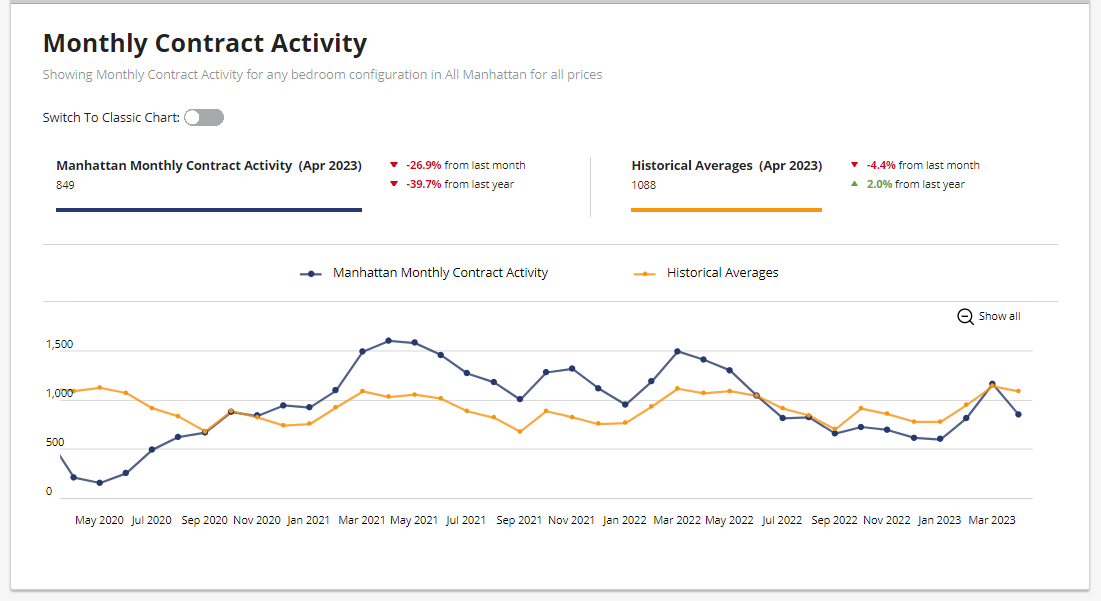

Monthly Contract Activity

Monthly Contract Activity resides at 849 (blue bar). The blue bar has merged with the historical average of 1088 (gold bar) and is in a range-bound market path. The Monthly Contract Activity (blue bar) is below the Historial Averages (yellow bar).

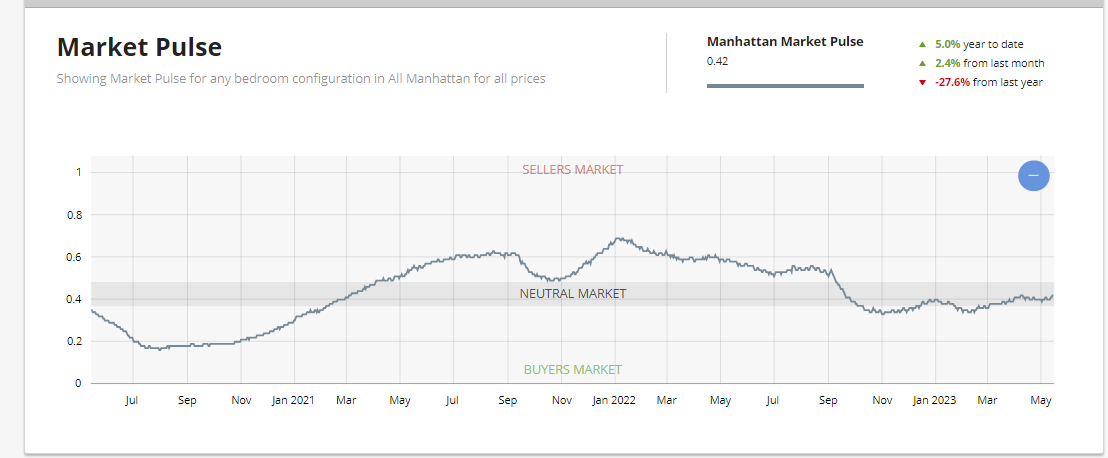

Market Pulse

The market pulse measures the ratio of Supply and demand seems to continue to evidence the beginning of the buy-side leverage peaking. The market pulse is residing in Neutral Territory – .4%. In the UrbanDigs Market Pulse, the Manhattan Pending Sales to Supply ratio is .41% (Leverage is going toward the sell side). 2,803 Contacts are waiting to close. In Manhattan, price discovery takes 4-6 months.

The weekly Supply is residing at “365”. The weekly contract signed dropped due to a holiday week and living at “244”. Off Market is higher than recently and stands at 127 listings. The drop in weekly contracts signed, significantly if prolonged, could weaken the market pulse, which is barely in the neutral zone, resulting in a compressed active season.

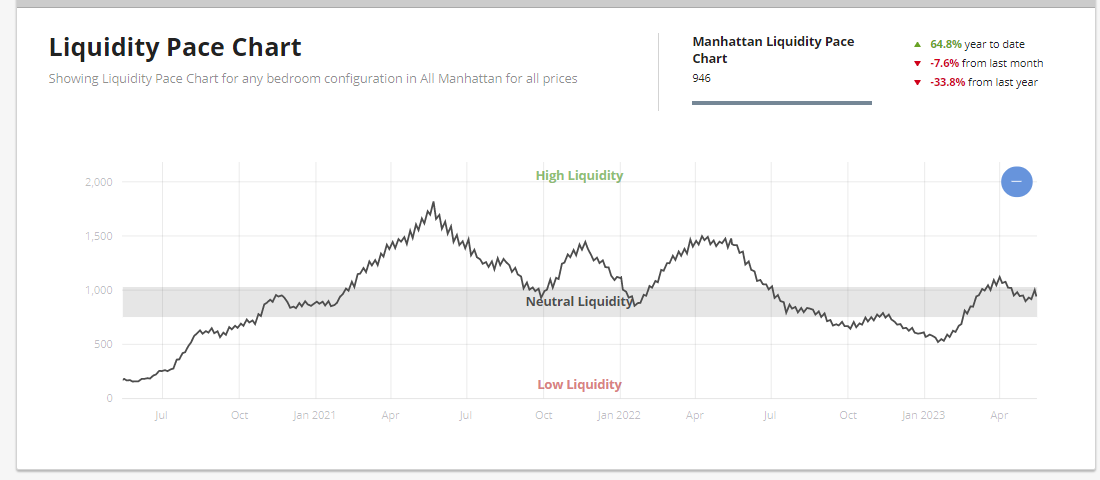

Liquidity Pace

This chart displays a 30-day moving window of contract activity for the Manhattan market. Low liquidity represents a slow market, while High liquidity represents a robust market. Urban Digs Market Pulse has moved up to.41%. The wobble in the pace of liquidity suggests Manhattan may have seen its highs this season.

New Development

“This week saw the highest demand for Manhattan and luxury new development in over a year. Additionally, for 16 weeks straight, the volume of contracts signed has exceeded the average volume from 2015-2019 before the pandemic*.”

– Kael Goodman, co-founder and CEO of Market Proof

Manhattan Luxury Market _ Wow – “40”

A significant milestone of 40 contracts signed for listings asking $4 million and up per the Olshan Report for the week of May 8th through 14th – Ten more than the previous week and the largest weekly total since the first week of May 2022. Of the 40 contracts, 29 were condos with an added two condops and four townhouses. And a special shout out to Bonnie Chajet, my colleague and recipient of REBNY’s Henry Forster Memorial Award, for an outstanding record of achievement and conduct within the industry– her signed contract for 101 CPW was the 5th-highest deal of the week!!

Condos – 29 | Coops – 5 | Condops – 2 and Townhouses – 4

Top 3 Contracts

- 15 Central Park West Unit 36D (Robert A.M. Stern| Asking $26.5 million

- 150 Barrow Street, Unit PHA | Townhouse | Asking $17.5 million

- 217 West 57th Street, Unit 58W, | Asking $16.475 million

Total Weekly Asking Price Sales Volume $300,444,000| Average Asking Price $7,511,10 | Median Asking Price: 5,925,000 | Average Discount from Original Ask to last Asking Price: 7% | Average Days on Market: 628

UrbanDigs Market Pulses needle moved towards sellers and resided at .42%. Weekly Supply is 385, Under Contract is 257, and Off Market is 106.

Demand for Manhattan & Luxury Reaches 12-Month High.

“Contract volume increased this week from 70 to 80 contracts, and all other metrics were significantly higher, which is unsurprising given the large number of high-value luxury deals. The average price rose from $2.5M to $3.2M, the average PPSF grew from $1,853 to $2,074, and the total dollar volume increased from $176M to $259M.

The $4M+ luxury sector recorded the most decisive week since November 2021, with 21 contracts compared to the pre-pandemic average of 8.

Of the 80 contracts signed this week, 52 (+86%) were in Manhattan, 25 (–32%) were in Brooklyn, and 3 (–40%) were in Queens.” reported Market Proof.

Manhattan Reports 52 Contracts Totaling $217M

“Contract and total dollar volumes posted their highest numbers over a year, at 52 (+86%) and $217M (+68%), respectively. Average price and average PPSF were down moderately to $4.2M (–10%) and $2,418 (–4%), respectively,” reported Market Proof.