Manhattan Market Report for the week ending February 17th, Supply closed out at 6,071 and trends up. Pending Sales at 2,198 and off-market listings (delisting) maintain the market pulse at a .36% level.

In the past few weeks, spurred by the good weather and lower rates the brokerage community is witnessing a more robust buyer activity. Multiple offer situations depend on the area, size, and price point. Additionally, listings that have languished for over 100 days now receive bids at the asking price. There are speculations that buyers are eager to make a move, with the possibility looming that the Fed will take more steps to tame inflation that will drive rates upward again.

Fed inclined toward quarter-point rate hikes at the next two meetings in March and May. In the Last Fed conference, Jerome Powell stated:

“it is our judgment that we’re not yet at a sufficiently restrictive policy stance, which is why we expect ongoing hikes to be appropriate. Of course, many things affect financial conditions—not just our policy. And we will take into account overall financial conditions along with many other factors as we set policy

Watching for the Big Flip

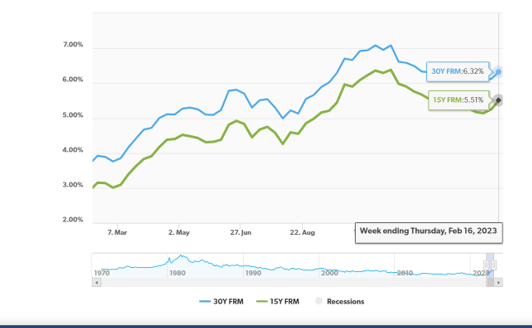

The Fed and their terminal rate rising and the bond market resetting to that new level for the last couple of months has tempered. The terminal rate is now at 5%. Financial groups are watching for “the big flip” by Jerome Powell, our Fed Chair, flipping the narrative and becoming hawkish. There is a camp that believes, at some point, to tame inflation, the Fed will start hiking rates a little more. While rates right now are reasonable from buyers’ perspective since they’ve come down. This is why buyers are coming back into the real estate market. However, rates could increase again, so buyers need to take advantage of this lower rate window opportunity. Jumbo rates are now lower than conforming rates. If the Fed changes and pivots and becomes hawkish, this turnabout will have a ripple effect in the markets. Rates will charge upward, and all of the markets will reset higher. This includes stocks, which may go lower, and the risk of deal value coming down.

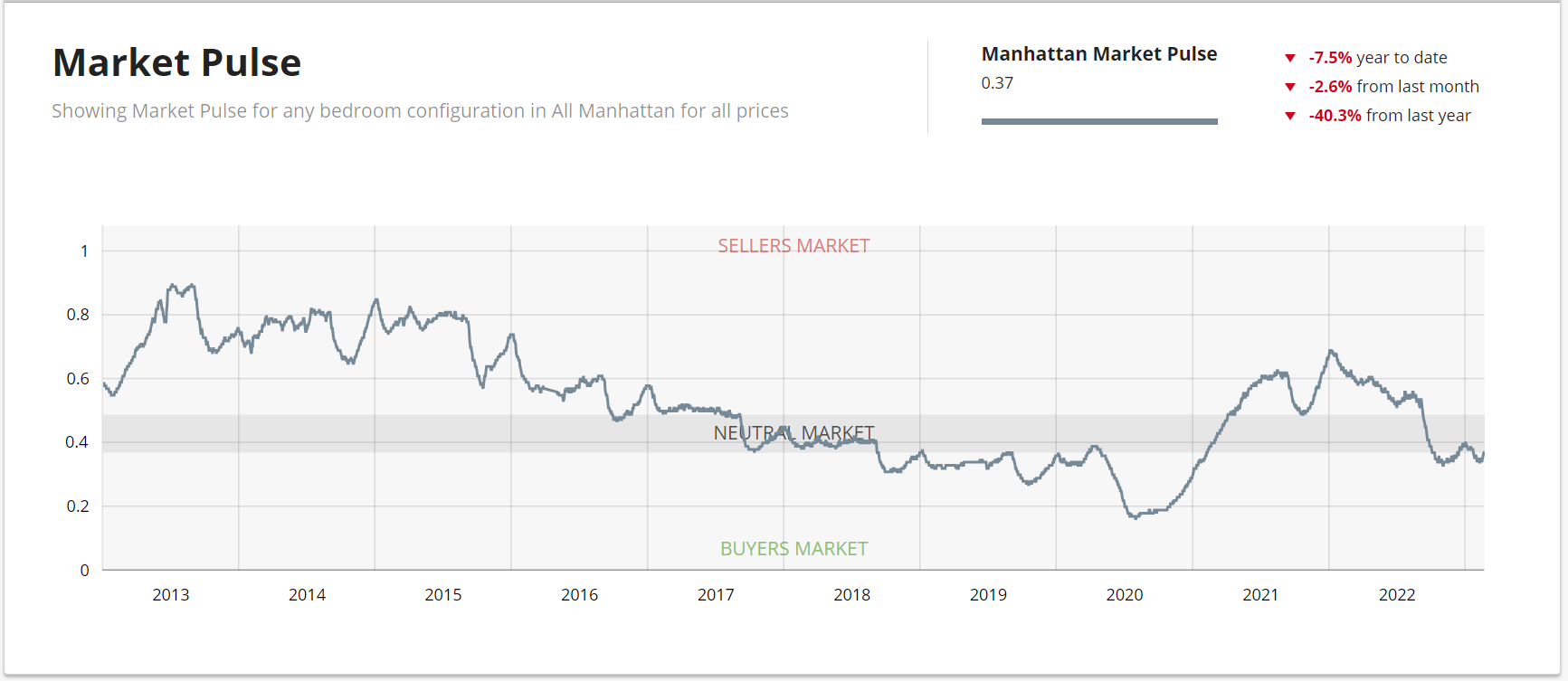

Market Pulse

The market pulse measures the ratio of supply and demand seems to continue to evidence the beginning of the buy-side leverage peaking. Continue looking for a “hockey stick” formation before the curve heads upward. The weekly supply is down and stands at 319. The weekly contract signed is down too and stands at “238”. Off Market is 141 listings. Some sellers capitulate and reduce list prices, but many choose to rent their property or remove the listing from the market altogether.

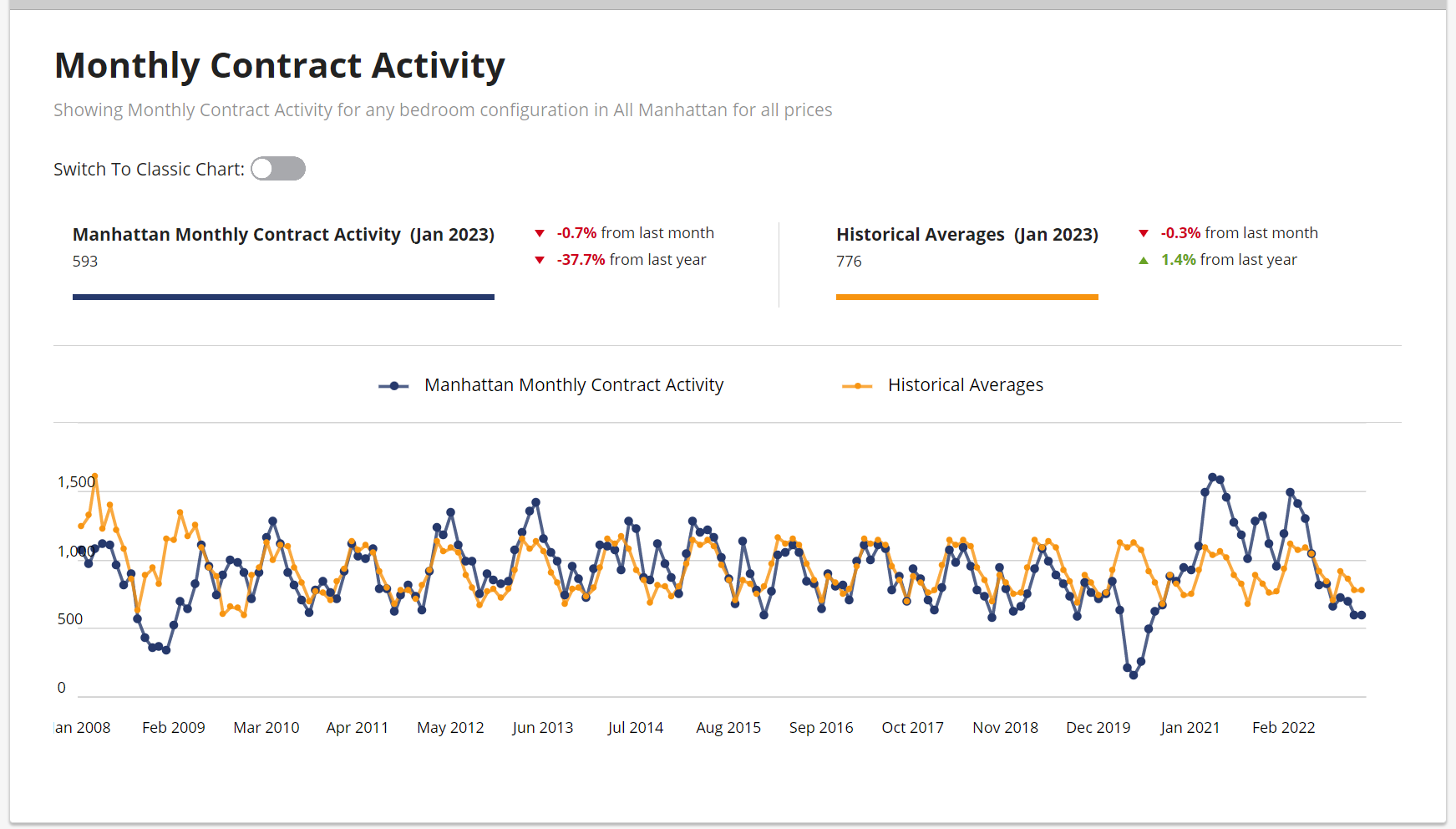

Monthly Contract Activity

Monthly Contract Activity resides at 776 (blue bar) trends below the historical averages (gold bar) and are in a range-bound market path. This path is classified as horizontal, ranging, or sideways bound between a high and low range. The monthly Contract Activity range depends on “rate volatility, the Fed, risk assets, credit spread, and other macro indicators.”

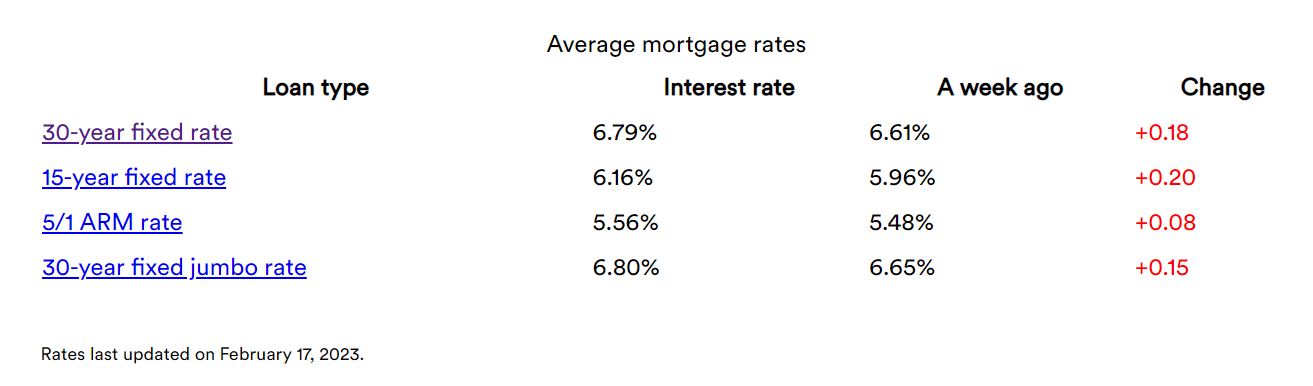

Mortgage Rates Increase for the Second Consecutive Week

Mortgage rates moved up for the second consecutive week. The economy is showing signs of resilience, mainly due to consumer spending, and rates are increasing. Overall housing costs are also increasing and therefore impacting inflation, which continues to persist.

New Development

“With contract volume now on a 4-week winning streak*, we’re closely watching the Fed. If inflation data continues to improve and mortgage rates fall, we see the potential for demand to accelerate above and beyond what is already expected for the Spring sales season.”– Kael Goodman, co-founder, and CEO

Good news to report for the holiday – 31 contracts were signed last week for listings asking $4 million and up. It’s the highest total since May 2022, just about the time the market changed (not for the better). It’s the third week in a row that more than 20 contracts were signed. Condos outsold coops 21-7 with 3 condops in the mix.

Many are hesitant to be overly optimistic and it’s really too early to read tea leaves – but those of you working with buyers should take note and suggest a sharper look at what’s happening: buyers who have been waiting for the market to continue its decline may find themselves, as Fred has often said ‘looking at the bottom of the market in the rearview mirror”

- The No. 1 contract was Hampshire House – 150 Center Park South on 27th Floor asking $30 million and sold in less than 2 weeks.

- The No. 2 contract was 30 Park Avenue, unit PH77A asking $19.75 million

- The No. 3 contract was 157 West 57th Street, unit 41D asking $19 million

Total Weekly Asking Price Sales Volume: $272,220,990| Average Asking Price: $8,818,332| Median Asking Price $6,250,000 | Average Discount from Original Ask to Last Asking Price: 6% | Average Days on Market: 505

Other educational articles about the market and your home search are under Karen’s Blog.