Manhattan Market Report for the week ending January 27th, Supply closed out at 6,026 and trends up for the first time this year above the 6,000 level. Pending Sales at 2,191 and off-market listings (delisting) maintain the market pulse at a .36% level.

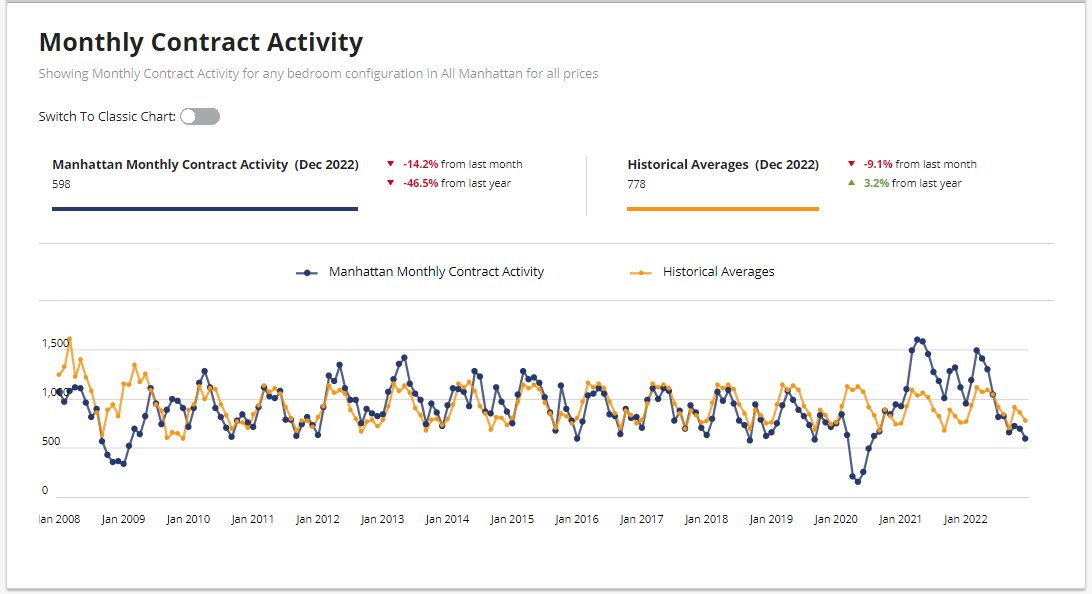

Monthly Contract Activity

Monthly Contract Activity resides at 778 (blue bar) trends below the historical averages (gold bar) and are in a range-bound market path. This path is classified as horizontal, ranging, or sideways bound between a high and low range. The monthly Contract Activity range depends on “rate volatility, the Fed, risk assets, credit spread, and other macro indicators.”

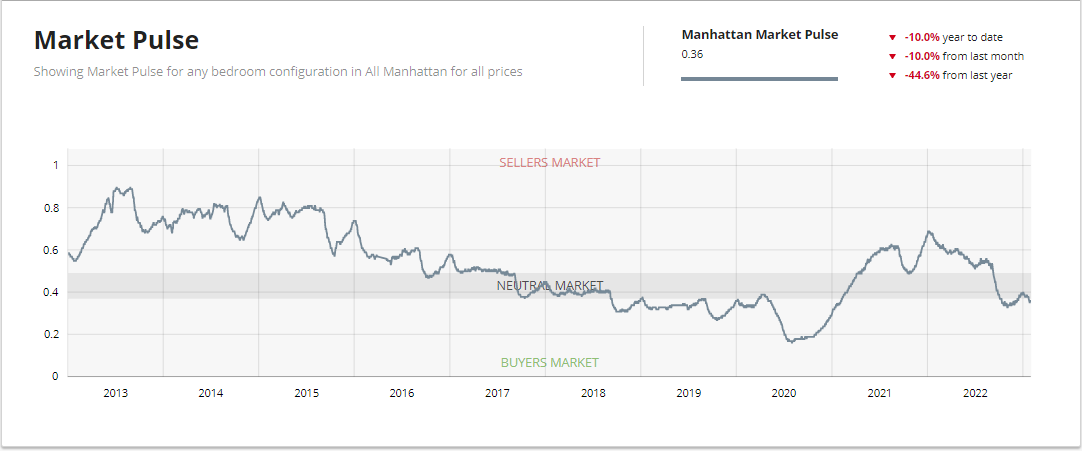

Market Pulse

The market pulse measures the supply and demand ratio seems to continue to evidence the beginning of the buy-side leverage peaking. UrbanDigs reports, “a bottom formation tends to occur when a decelerating market starts to show signs of a positive turnaround. This reshapes the downward slope to a flatter one and sometimes, but not always, precedes a period of recovery.

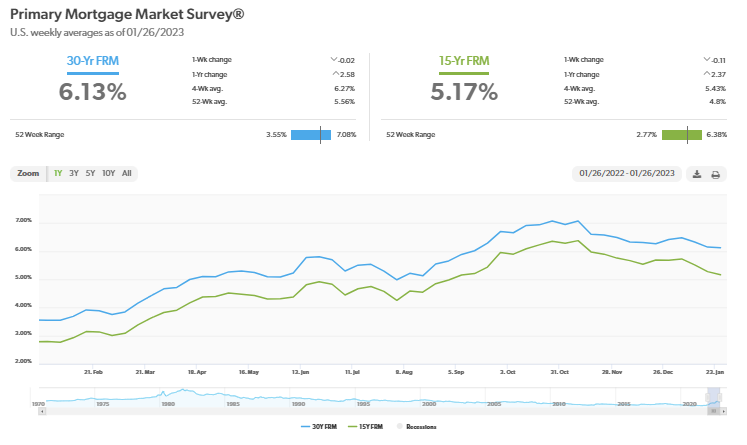

Mortgage Rates Trend Down

Freddie Mac, as of January 26, 203, reports Mortgage rates to continue to tick down, resulting in home purchase demand thawing from the months-long freeze that gripped the housing market. Potential homebuyers remain sensitive to changes in mortgage rates, but significant demand remains fueled by first-time homebuyers.

Luxury Market

“Even after accounting for what appears to be a release of previously unreported contracts at The Greene and a poor showing from the luxury segment, demand was higher this week and approaching its pre-pandemic benchmark for the first time in months. After all, rising mortgage rates ended the record demand, so it’s conceivable that retreating rates are slowly beginning to open the buyer spigot once again.”

– Kael Goodman, co-founder, and CEO

Olshan Report week of January 23rd – 29th report fifteen contracts signed for listings asking $4 million and up. Surprisingly, an equal number of co-ops and condos were included – 7 contracts for condos and 7 for coops. That hasn’t happened since December 2020. Donna reports that it’s five weeks since Manhattan registered more than 20 signed contracts at $4 million and up.

Total Weekly Asking Price Sales Volume: $114,539,000 | Average Asking Price: $7,635,933 | Median Asking Price $5,850,000 | Average Discount from Original Ask to Last Asking Price: 8% | Average Days on Market: 557

Other educational articles about the market and your home search are under Karen’s Blog.