Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible.

Mortgage Rates Will Continue To Respond to Inflation

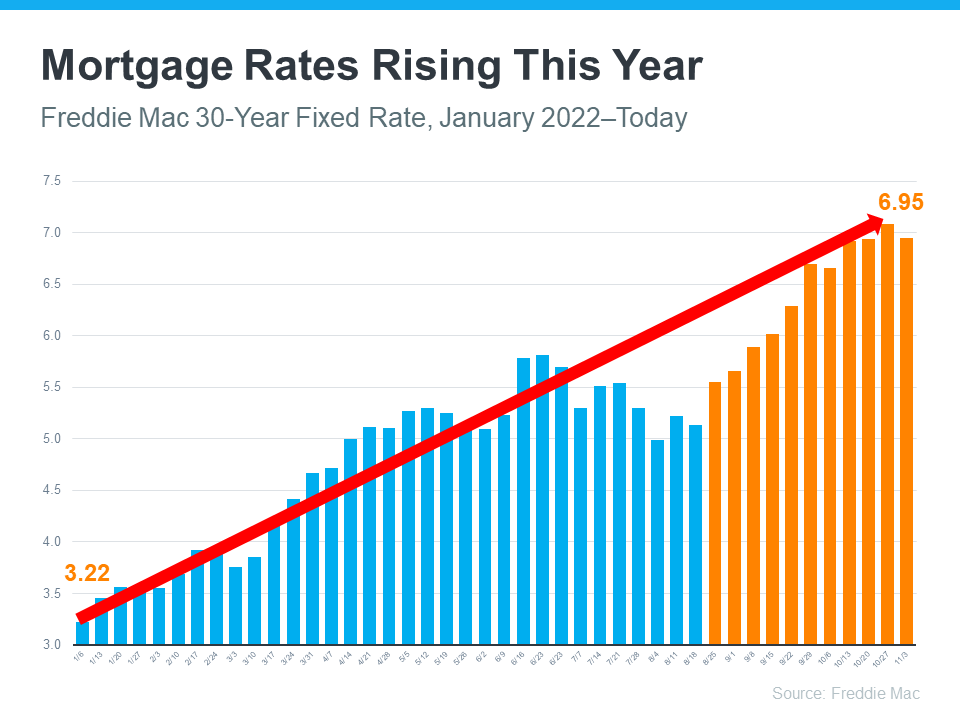

There’s no doubt mortgage rates have skyrocketed this year as the market responded to high inflation. The increases we’ve seen were fast and dramatic, and the average 30-year fixed mortgage rate even surpassed 7% at the end of last month. In fact, it’s the first time they’ve risen this high in over 20 years (see graph below):

In their latest quarterly report, Freddie Mac explains just how fast the climb in rates has been:

“Just one year ago, rates were under 3%. This means that while mortgage rates are not as high as they were in the 80’s, they have more than doubled in the past year. Mortgage rates have never doubled in a year before.”

Because we’re in unprecedented territory, it’s hard to say with certainty where mortgage rates will go from here. Projecting the future of mortgage rates is far from an exact science. Experts do agree that moving forward, mortgage rates will continue to respond to inflation. If inflation stays high, mortgage rates likely will too.

Common Loan Products

For residential transactions, common loan products include the standard 30-Year Fixed mortgage as well as various adjustable-rate loans. According to David Breitstein, a mortgage broker at GuardHill Financial with over 20 years of experience in the industry. The difference in rates for each loan product can be substantial.

For example, the difference in interest rate between a 5/1 ARM and a 30-Year Fixed may differ by as much as 1.25% to 1.5%. This means a difference in a monthly payment of $81 per $100,000 borrowed. In the case of a $1,000,000 mortgage, the additional payments are nearly $10,000 per year.

Analyzing Time Horizon

When considering the “various loan products available, purchasers should earnestly analyze their time horizon for a property, their current and future lifestyle needs, and personal risk tolerance. The average first-time home buyer of a co-op or condominium apartment will likely keep their property for 3-5 years before their family or lifestyle needs outgrow the home, while buyers of investment properties may hold the property for longer. Buyers who intend to occupy a property for the full 30-year life of a loan may want to prioritize a lower interest rate, while a buyer who intends to sell in a few years may ultimately save money by avoiding higher monthly payments” states Richard and Hale Coopersmith counselors of law.

Rate Lock

With “rising interest rates, many buyers are eager to lock their rates as soon as possible. However, borrowers may require to pay additional fees at closing to lock in or extend an interest rate beyond the traditional 60-90 days. If the rate lock period must be extended, the extension fees can be significant. It is therefore important to consider any potential delays in the closing timeline and weigh the long-term cost of a higher rate against the associated rate lock fees” states Richard and Hale Coopersmith counselors of law.

New York City Coops

In New York City, “purchases of co-op apartments, in particular, can take longer than other transactions, sometimes more than 90 days after the contract. Buyers should be mindful of extended contract negotiations, complexities in the loan and board application processes, when the next board meetings will be, how quickly the building typically reviews and approves applications, and how long the board

and its management company typically need to prepare for closing after approval. These are the most common points of delay which may cause a closing date to surpass a rate lock expiration, costing buyers extensive fees to maintain their loan terms” states Richard and Hale Coopersmith counselors of law.

Bi-Weely Mortgages

After closing, “borrowers may also consider opting for higher or more frequent payments (e.g., biweekly instead of monthly payments) to pay down the loan faster. Accelerated biweekly loans shorten the repayment period of the loan, and in turn, save on interest paid on the term of the loan. For example, a 30-Year Mortgage at a loan amount of $500,000 and a rate of 6.5% will pay nearly $638,000 of interest over the 30-year amortization period. For the accelerated biweekly loan, the repayment period of the loan will be reduced to 25.5 years with $489,000 of interest payments, a savings of approximately $150,000” states Richard and Hale Coopersmith counselors of law.

Assignment of Mortgage

Once a loan product is chosen, “borrowers may consider arranging an assignment of mortgage with their seller in order to save on closing costs. The mortgage recording tax ranges from 0.75-2.8% of the loan amount depending on the location and type of property and is paid by the borrower at closing. A $1,000,000 loan, for example, on a single-family home in New York City would incur a charge of $19,220 at closing, a significant expense that may be reduced or altogether avoided by an assignment.

If a seller has an existing mortgage on the property, they can assign their loan to the buyer, even if the lender and terms of the loan are different, and the buyer will then only be responsible for paying the mortgage recording tax on the “new money”, or the difference between the seller’s and buyer’s loans.

Therefore, if the seller has a loan of $750,000 remaining on the property at closing. The buyer’s mortgage recording tax would be based only on the $250,000 difference between the two loans, bringing the charge down to $4,470. An assignment of a mortgage also triggers a continuing lien deduction, which benefits the seller states Richard and Hale Coopersmith counselors of law.

Learn more about continuing lien deduction, also known as A Consolidation Extension and Modification Agreement (“CEMA”) a strategy for saving money at closing HERE. As well as, “Lowering Real Estate Transaction Costs Through Mortgage Assignments by Hal Coopersmith, attorney at law HERE.

Home Price Changes Will Vary by Market

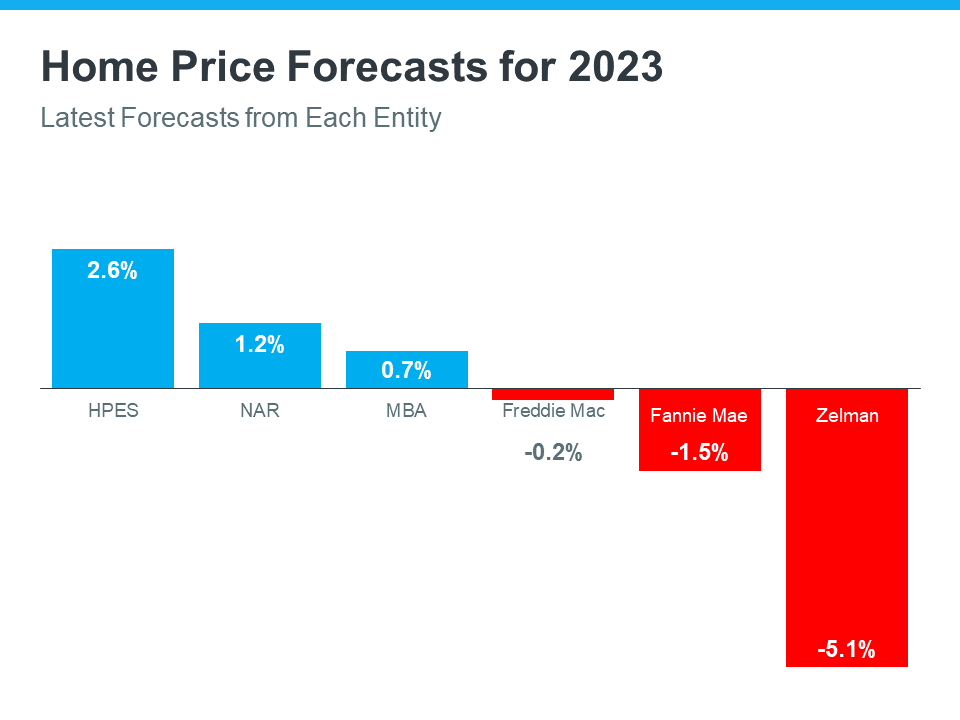

As buyer demand has eased this year in response to those higher mortgage rates, home prices have moderated in many markets too. In terms of the forecast for next year, expert projections are wide-ranging. The general consensus is home price appreciation will vary by the local market, with more significant changes happening in overheated areas. As Mark Fleming, Chief Economist at First American, says:

“House price appreciation has slowed in all 50 markets we track, but the deceleration is generally more dramatic in areas that experienced the strongest peak appreciation rates.”

Basically, some areas may still see slight price growth while others may see slight price declines. It all depends on other factors at play in that local market, like the balance between supply and demand. This may be why experts are of different opinion on their latest national forecasts (see graph below)

Key Takeaway

If you want to know what’s happening with home prices or mortgage rates, let’s connect so you have the latest on what experts are saying and what that means for our area.