The biggest challenge the housing market faces is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply:

“Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeownersandthe fear of not finding something to buy.”

Let’s break down these two big issues in today’s housing market.

Rate-Locked Homeowners

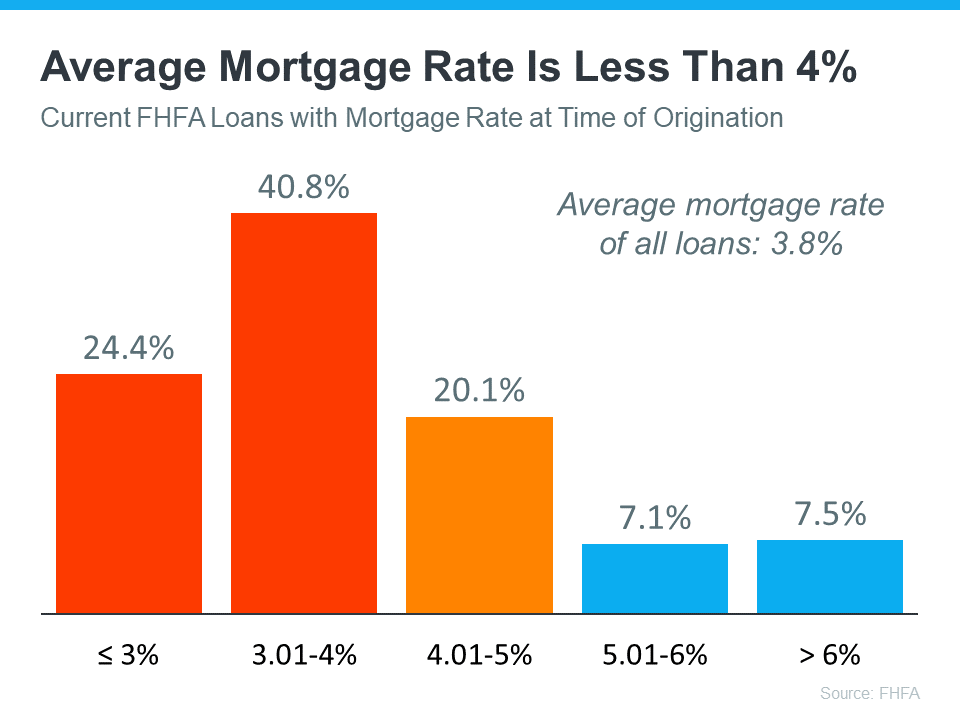

According to the Federal Housing Finance Agency (FHFA), the average interest rate for current homeowners with mortgages is less than 4% (see graph below):

But today, the typical mortgage rate offered to buyers is over 6%. As a result, many homeowners are opting to stay put instead of moving to another home with a higher borrowing cost. This is a situation known as being rate locked.

When so many homeowners are rate locked and reluctant to sell, it’s a challenge for a housing market that needs more inventory. However, experts project mortgage rates will gradually fall this year, and that could mean more people will be willing to move as that happens.

The Fear of Not Finding Something To Buy

The other factor holding back potential sellers is the fear of not finding another home to buy if they move. Worrying about where they’ll go has left many on the sidelines as they wait for more homes to come to the market. That’s why, if you’re on the fence about selling, it’s important to consider all your options. That includes newly built homes, especially when builders offer concessions like mortgage rate buydowns.

What Does This Mean for You?

These two issues keep the supply of homes for sale lower than pre-pandemic levels. But if you want to sell your house, today’s market is a sweet spot that can work to your advantage.

Be sure to work with a local real estate professional to explore the options you have right now, which could include leveraging your current home equity. According to ATTOM:

“. . . 48 percent of mortgaged residential properties in the United States were considered equity-rich in the fourth quarter, meaning that the combined estimated amount of loan balances secured by those properties was no more than 50 percent of their estimated market values.”

This could make a major difference when you move. Work with a local real estate expert to learn how putting your equity to work can decrease your next home’s cost.

Watching for the Big Flip

The Fed and their terminal rate rising and the bond market resetting to that new level for the last couple of months has tempered. The terminal rate is now at 5%. Financial groups are watching for “the big flip” by Jerome Powell, our Fed Chair, flipping the narrative and becoming hawkish. There is a camp that believes, at some point, to tame inflation, the Fed will start hiking rates a little more. While rates right now are reasonable from buyers’ perspective since they’ve come down. This is why buyers are coming back into the real estate market. However, rates could go up higher again so it’s essential for buyers to take advantage of this lower rate window opportunity. Jumbo rates are now lower than conforming rates. If the Fed changes and pivots and becomes hawkish, this turnabout will have a ripple effect in the markets. Rates will charge upward, and all of the markets will reset higher. This includes stocks, which may go lower, and the risk of deal value coming down.

Key Takeaway

Rate-locked homeowners and the fear of not finding something to buy are keeping housing inventory low across the country. But as mortgage rates start to come down this year and homeowners explore all their options. Then, we should expect more homes to come to the market.

Other educational articles about the market and your home search are under Karen’s Blog.