If you’re trying to decide whether to rent or buy a home this year, here’s a powerful insight that could give you the clarity and confidence you need to make your decisions.

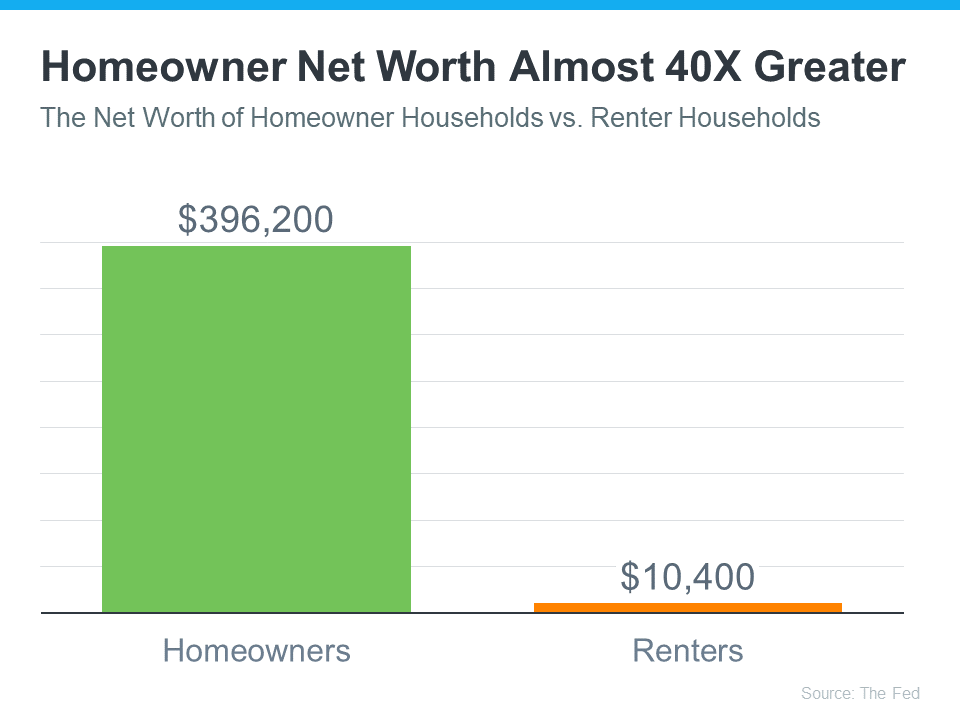

The latest report shows the average homeowner’s net worth is almost forty times (40X) greater than a renter’s (see graph below). Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares the net worth of homeowners and renters.

A wealth gap exists between renters and homeowners because when you’re a homeowner, your equity grows as your home appreciates in value and you make your mortgage payment each month. When you own a home, your monthly mortgage payment acts like a form of forced savings, eventually paying off when you decide to sell. As a renter, you’ll never see a financial return on the money you pay out in rent every month. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

The Largest Part of Most Homeowner Net Worth Is Their Equity

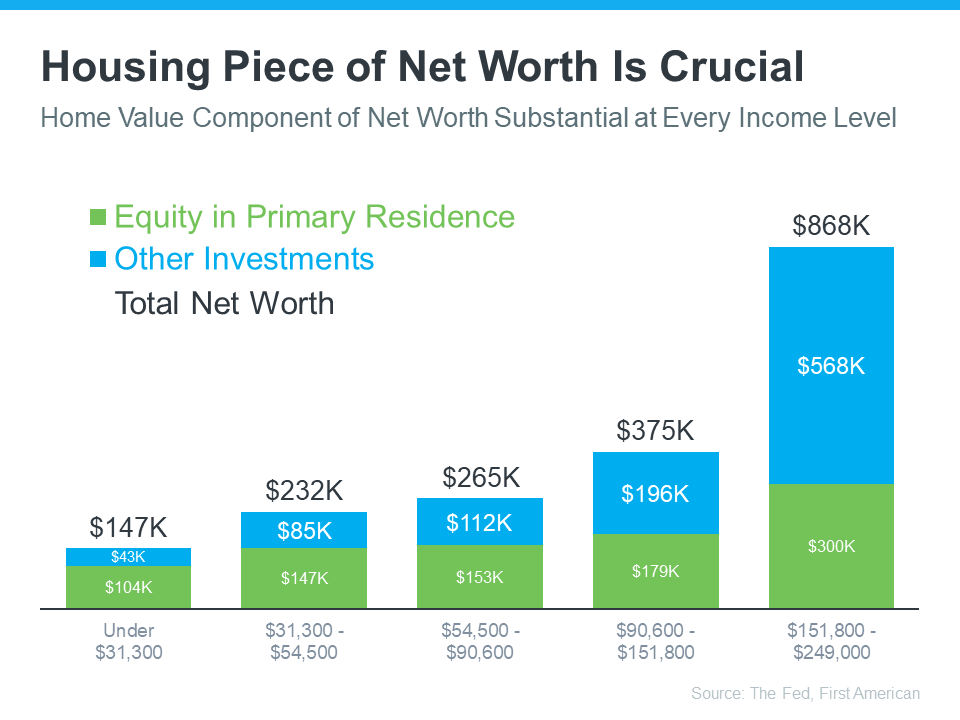

Home equity builds the average household’s wealth more than anything else. According to data from First American and the Federal Reserve, this holds across different income levels (see graph below):

The green segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with mortgage rates trending lower lately, your purchasing power may be higher now than it has been in months. And, with more inventory coming to the market, there are more options for you to consider. A local real estate agent can walk you through your opportunities today and guide you through finding your ideal home.

Key Takeaway

If you’re unsure whether to rent or buy a home, remember that owning a home can increase your overall wealth in the long run, regardless of your income. Let’s connect to discover more about this and the many other benefits of homeownership.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.