The rising cost of almost everything from groceries to gas right now leads to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that many foreclosures are on the horizon. While it’s true that foreclosure filings have gone up a bit compared to last year, experts say a flood of foreclosures isn’t coming.

Take it from Bill McBride of Calculated Risk. McBride is an expert on the housing market. After closely following the data and market environment leading up to the crash, he saw the foreclosures coming in 2008. With the same careful eye and analysis, he has a different take on what’s ahead in the current market:

“There will not be a foreclosure crisis this time.”

Let’s look at why another flood is so unlikely.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgage Payments

One of the main reasons there were so many foreclosures during the last housing crash was that relaxed lending standards made it easy for people to take out mortgages, even if they couldn’t show that they’d be able to pay them back. At that time, lenders weren’t stringent when assessing applicant credit scores, income levels, employment status, and debt-to-income ratio.

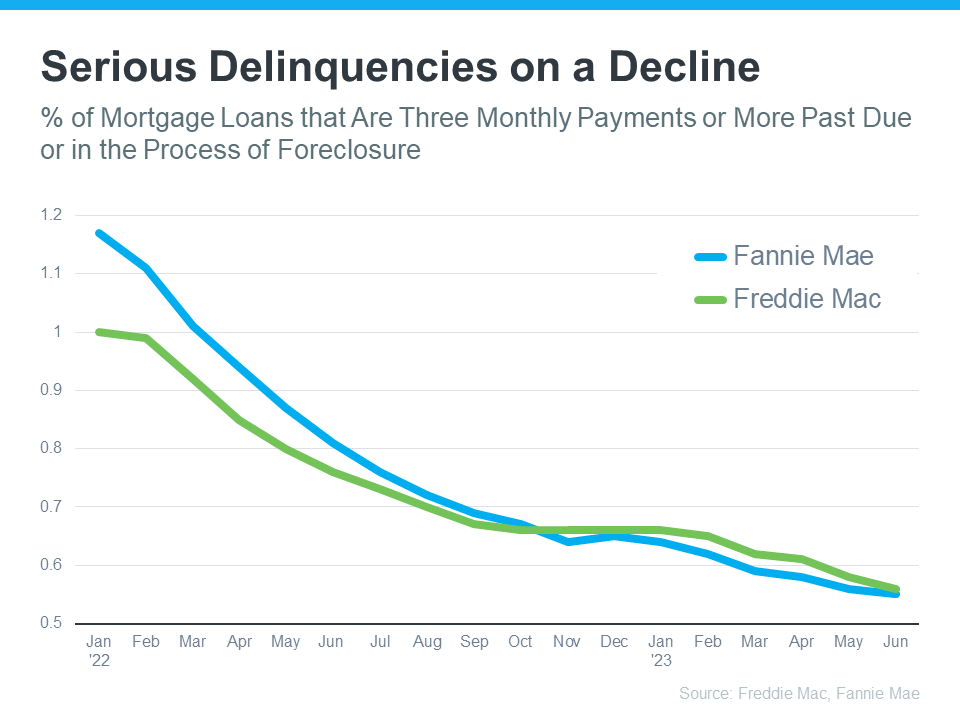

But now, lending standards have tightened, leading to more qualified buyers who can afford to make their mortgage payments. And data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments is declining (see graph below):

Molly Boese, Principal Economist at CoreLogic, explains just how few homeowners are struggling to make their mortgage payments:

Molly Boese, Principal Economist at CoreLogic, explains just how few homeowners are struggling to make their mortgage payments:

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

Before a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise. Since so many buyers are making their payments today, a wave of foreclosures isn’t likely.

Key Takeaway

If you’re worried about a potential flood of foreclosures, know there’s nothing in the data today to suggest that’ll happen. Qualified buyers are making their mortgage payments at a very high rate.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.