Buying a home, you may be pondering if it makes sense to do so right now. While today’s mortgage rates might seem intimidating, here are two compelling reasons why it may still be an excellent time to become a homeowner.

Home Values Appreciate Over Time

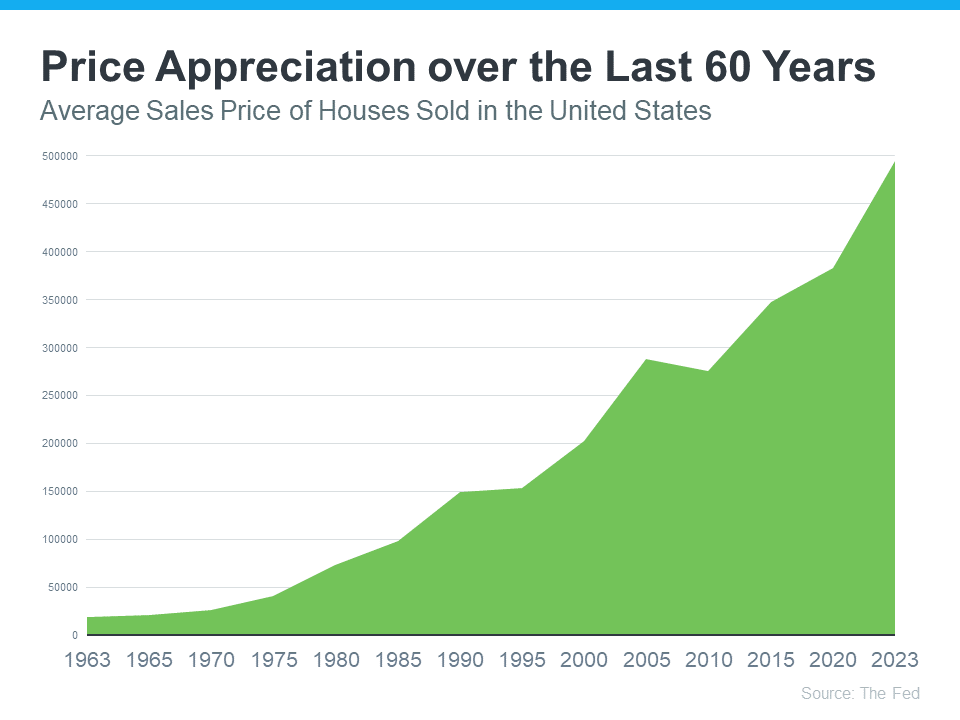

There’s been a lot of confusion around what’s happened with home prices over the past two years. While they did dip ever so slightly in late 2022, this year, they’ve been appreciating at a more normal pace, which is good news for the housing market. While looking at price movement over just a year or two can make you worry prices are usually this unpredictable, history shows in the long run, home values rise (see graph below):

Using data from the Federal Reserve for the past 60 years, you can see that home prices have steadily climbed. Sure, there was an exception around the housing crash of 2008 that caused prices to break the usual trend for a time, but overall, home values have been consistently on the rise.

Increasing home values is one reason buying may make more sense than renting. As prices rise and you pay down your mortgage, you build equity. Over time, that growing equity gives your net worth a boost.

Rent Keeps Going Up Through the Years

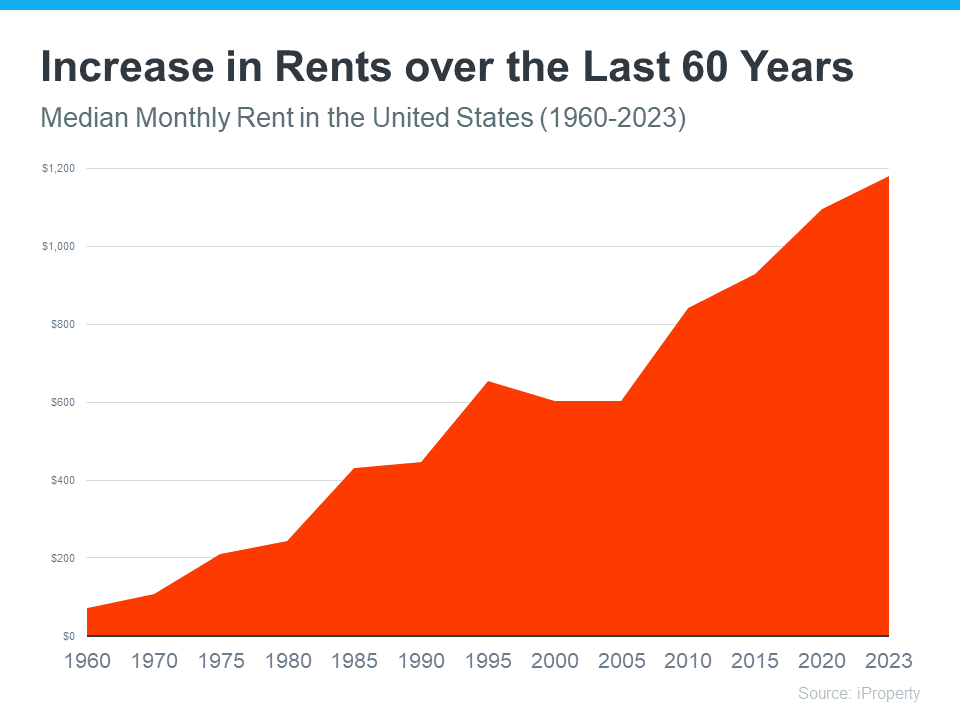

Another reason you may want to consider buying a home instead of renting is the never-ending rent hike. If you’ve ever felt the pinch of rent increasing year after year, you’re not alone. That’s because rents have climbed steadily over the past six decades (see graph below):

Buying a home can lock in your monthly housing costs and bid farewell to those pesky rent hikes. That stability is a game-changer.

Ultimately, it all boils down to this: your housing payments are an investment, and you have a choice to make. Do you want to invest in yourself or your landlord?

By becoming a homeowner, you’re investing in your future. When you rent, that’s money you never get back.

Homeownership can be a path to financial security when you factor in home values consistently rising, plus the opportunity to get relief from never-ending rent hikes. As Dr. Jessica Lautz, Deputy Chief Economist and VP of Research at the National Association of Realtors (NAR), states:

“If a homebuyer is financially stable, able to manage monthly mortgage costs and can handle the associated household maintenance expenses, then it makes sense to purchase a home.”

Key Takeaway

When it comes down to it, buying a home offers more benefits than renting, even when mortgage rates are high. If you want to avoid increasing rents and take advantage of long-term home price appreciation, let’s discuss your options.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.