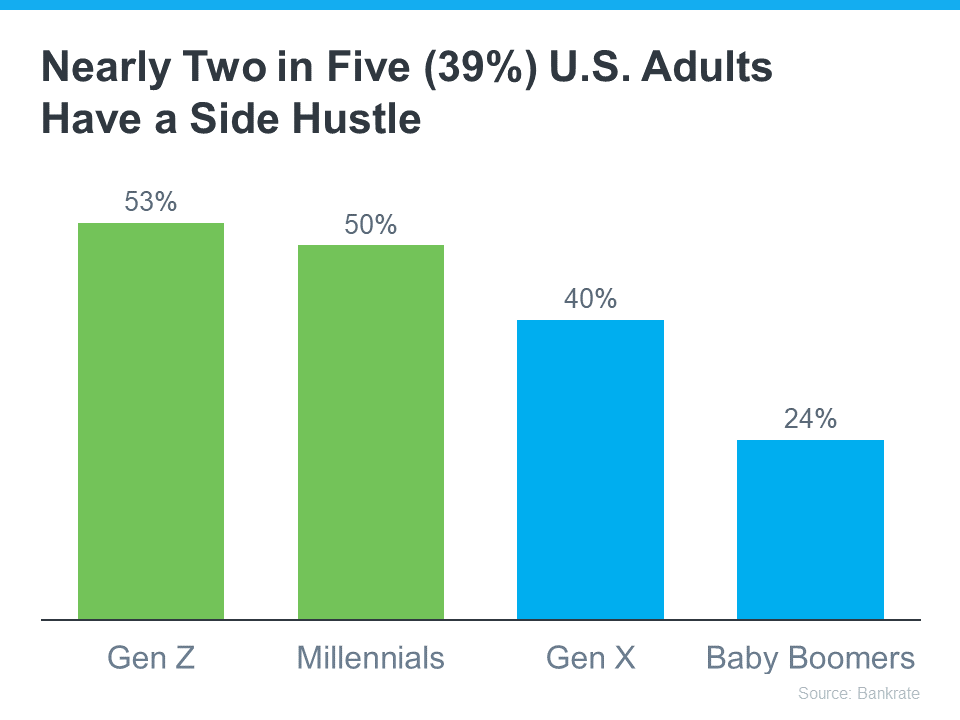

Does the rising cost of Homeownership and the cost of almost everything these days make your dream of owning your home feel less within reach? According to Bankrate, many people seek additional income through side hustles, possibly to cope with those increasing expenses and save for a home. This trend is particularly popular with younger individuals who may be dealing with student loan debt (see graph below):

Here are two strategies that can make homeownership more affordable in the short term and turn it into a lucrative side hustle that can pay off down the road.

Transforming the Challenge of a Fixer-Upper into an Opportunity

One thing you could do to help you break into homeownership is consider purchasing a fixer-upper. That home may be a bit less appealing and, as a result, has lingered on the market longer than normal. According to a recent article from U.S. News:

“The current state of the housing market may have you expanding your options to try to find a home that you can afford. A fixer-upper that needs some updating and a little love can feel like a welcome alternative to move-in ready houses that go off the market before you can even take a tour.”

By opting for a home that requires some work, you may see two big benefits. For starters, you may find it’s easier to find a home because you’re not looking for that perfect option. It may also help you enter the housing market at a lower price point. This strategy provides a more affordable way to become a homeowner while offering the potential for future profits.

Yes, the home may need a little elbow grease, but investing time and effort into gradually enhancing your house makes it a home and increases its future market value. So, while you enjoy the satisfaction of turning a house into a home, you’re also building equity that can be unlocked when it’s time to sell.

Renting Out a Portion of Your Home To Make It More Affordable

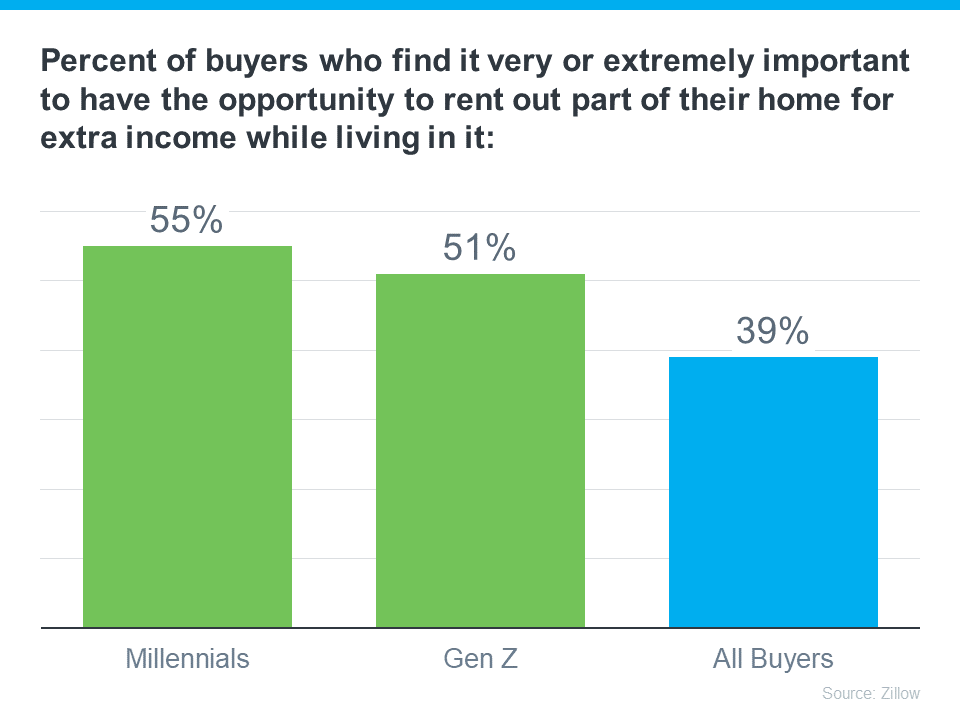

Another savvy strategy is to purchase a home with the upfront intention of renting out a portion of it. According to a recent press release from Zillow, renting out a part of their home is already very important for most young homebuyers (see graph below):

This approach serves a strong purpose. As Manny Garcia, Senior Population Scientist at Zillow, says:

“For those first-time buyers navigating the ‘side hustle culture,’ where a regular 9-to-5 might not quite cut it for homeownership dreams, rental income can step in to help . . .”

It can help you afford your monthly mortgage payments. So if you’re open to it, renting out a portion of your home not only helps with affordability, but it also positions you as an investor and turns your home into a source of income.

Key Takeaway

In the face of today’s affordability challenges, both of these strategies offer more attainable paths to homeownership, especially for younger buyers. If you want to discuss these options and see how they might play out for you in our local market, let’s connect.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.