If you’re considering buying a home, you may find yourself interested in the latest real estate headlines so you can keep an eye on all the things that could impact your decision. If that’s the case, you’ve probably heard mention of investors and wondered how they affect the housing market. That could leave you asking yourself questions like:

- How many homes do investors own?

- Are institutional investors, like large Wall Street Firms, buying up so many homes that the average person can’t find one?

To answer those questions, here’s the real story of what’s happening based on the data.

Let’s start by establishing how many single-family homes (SFHs) are and what portion of those investors own rentals. According to SFR Investor, which studies the single-family rental market in the United States, there are eighty-two million single-family homes in this country. But how many of them are rentals?

According to data shared in a recent post, sixty-eight million (82.93%) of those homes are owner-occupied – meaning the person who owns the home lives in it. If you subtract that sixty-eight million from the total number of single-family homes (82 million), that leaves just about fourteen million homes left that are single-family rentals (SFRs).

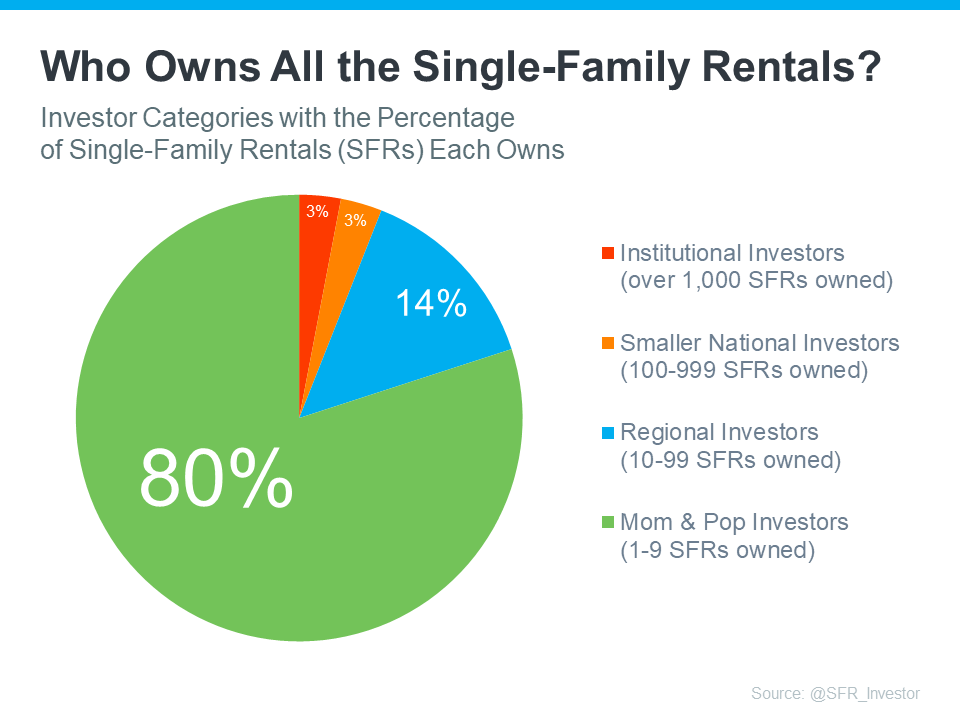

Do institutional investors own all of those remaining fourteen million homes? Not even close. Let’s take it one step further. There are four categories of investors:

- The mom & pop investor who owns between 1-9 SFRs

- The regional investor who owns between 10-99 SFRs

- A smaller national investor who owns between 100-999 SFRs

- The institutional investor who owns over 1,000 SFRs

These categories show that not all investors are large institutional investors. To help convey that even more clearly, here are the percentages of rental homes owned by each type of investor (see chart below):

As you can see in the chart, despite what the news and social media would have you believe, the green shows large institutional investors do not own the vast majority. Instead, most are owned by small mom-and-pop investors, like your friends and neighbors.

What’s happening is that there are people out there, just like you, who believe in homeownership. They view buying a home (or a second home) as an investment. Maybe they saw an opportunity to buy a second home over the last few years to use it as a rental and generate additional income. Or perhaps they just decided to keep their first house rather than sell it when they moved up.

So, don’t believe everything you read or hear about institutional investors. They aren’t buying all the homes and making it impossible for the average person to buy. That’s just not what the numbers show. Institutional investors are the smallest piece of the pie chart.

Key Takeaway

While it’s true that institutional investors are a player in the single-family rental marketplace, they’re not buying up all of the houses on the market. If you have other questions about things you’re hearing about the housing market, let’s connect so you have an expert to give you the context you need.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.