You may see media coverage talking about a drop in homeowner equity. What’s important to understand is that there is a symbiotic connection between equity and home values. So, when home prices appreciate, you can expect equity to grow. And when home prices decline, equity does too.

Equity can be defined as the amount of money the owner of an asset would be paid after selling it. Including any debts associated with the asset were paid off. For example, if you own a home worth $200,000 and you have a mortgage of $50,000. The equity in the home would be worth $150,000 – “TD Bank.”

Here’s how this has played out recently.

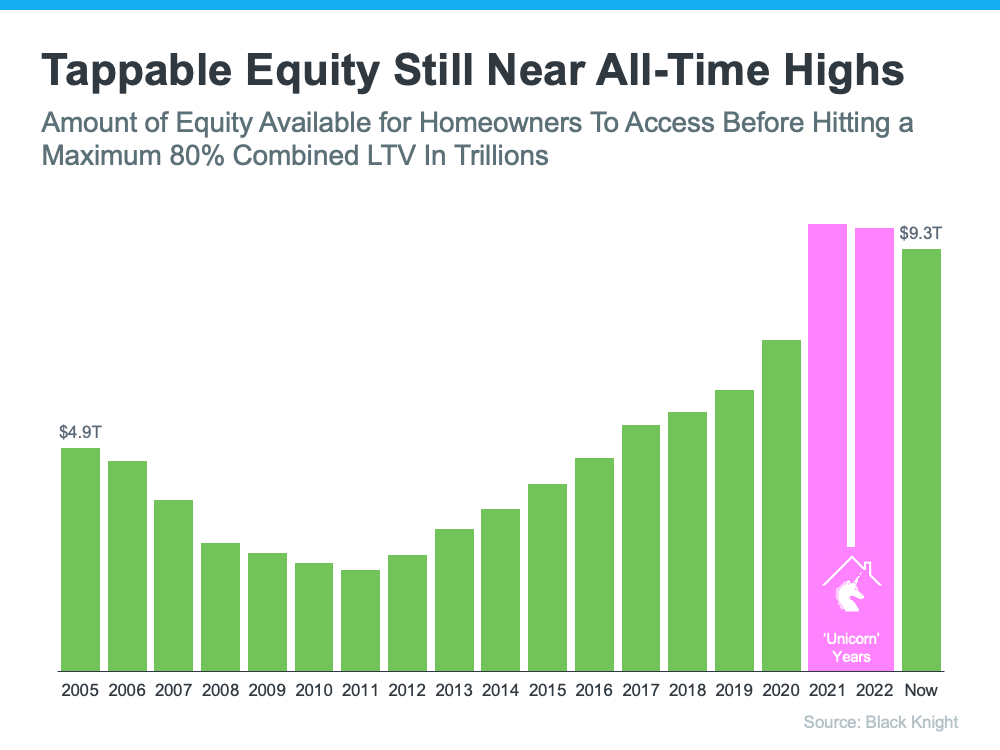

Home prices rose rapidly during the ‘unicorn’ years. That gave homeowners a considerable asset boost. But those ‘unicorn’ years couldn’t last forever. The market had to moderate at some point, which we saw last fall and winter.

Home prices dropped slightly in the back half of 2022, adjusting equity. Based on the most recent report from CoreLogic, there was a 0.7% dip in homeowner value over the last year—however, the headlines reporting that change isn’t painting the whole picture. At the same time, home price depreciation during the second half of last year caused value to drop. The data shows homeowners still have near-record amounts of equity.

The graph below helps illustrate this point. They are looking at the total amount of tappable equity in this country going back to 2005. Tappable equity is the amount of equity available for homeowners to access. This is before hitting a maximum 80% loan-to-value ratio (LTV). The data shows a significant equity boost during the ‘unicorn’ years as home prices rapidly appreciated (see the pink in the graph below).

But here’s what’s key to realize – even though there’s been a small dip, total homeowner equity is still much higher than before the ‘unicorn’ years.

And there’s more good news. Recent home price reports show the worst home price declines are behind us, and prices have started to go up again. As Selma Hepp, Chief Economist at CoreLogic, explains:

“Home equity trends closely follow home price changes. As a result, while the average amount of equity declined from a year ago, it increased from the fourth quarter of 2022, as monthly home prices growth accelerated in early 2023.”

The last part of that quote is particularly important. Especially since it is the puzzle piece the news is leaving out. To further emphasize the positive turn. Experts say home prices are forecast to appreciate at a more normal rate over the next year. In the same report, Hepp puts it this way:

“The average U.S. homeowner now has more than $274,000 in equity – up significantly from $182,000 before the pandemic. Also, while homeowners in some areas of the country who bought a property last spring have no equity as a result of price losses, forecasted home price appreciation over the next year should help many borrowers regain some of that lost equity.”

And even though Odeta Kushi, Deputy Chief Economist at First American, references a slightly different number, Kushi further validates the fact that homeowners have a lot of equity right now:

“Homeowners today have an average of $302,000 in equity in their homes.”

That means if you’ve owned your home for a few years, you likely still have way more equity than before the ‘unicorn’ years. And if you’ve owned your home for a year or less. The forecast for more typical price appreciation over the next year should mean your equity is already on the way back up.

Key Takeaway

Context is everything when looking at headlines. While homeowner market value dropped some from last year, it’s still near all-time highs. Let’s connect so you can get the answers you deserve from an expert here to help as you plan your move this year.

Other educational articles about the market and your home search are under Karen’s Blog. Additionally, explore the search bar for other topics of interest.