Manhattan Market Report for the week ending May 5, 2023, Supply closed out at 7,365, up 2%. Pending Sales increase and sits at 2,955; off-market listings (delisting) maintain the market pulse at a .41% level. At the spring topping point. The seller’s liquidity is here, so take action. We are at the top of the peak selling season, so in another 45 days, the summer lull begins. Price your property to ascertain buyers’ attention by pricing at or below the market pricing expectation. The buyer’s listing discount is around 5% for the market overall. Some listings have multiple offers, so it’s essential to understand the local market you plan to transact in, not base your offer price on national real estate news.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” — Robert G. Allen.

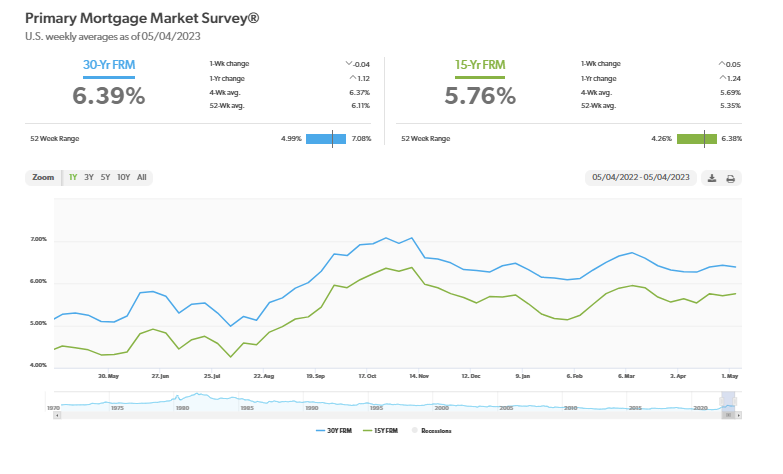

Mortgage Rates Tick Down

This week, mortgage rates inched down slightly amid recent volatility in the banking sector and commentary from the Federal Reserve on its policy outlook. Spring is typically the busiest season for the residential housing market, and, despite rates hovering in the mid-six percent range, this year is no different. Interested homebuyers are acclimating to the current rate environment, but the lack of inventory remains a primary obstacle to affordability. – Freddie Mac – May 4, 2023

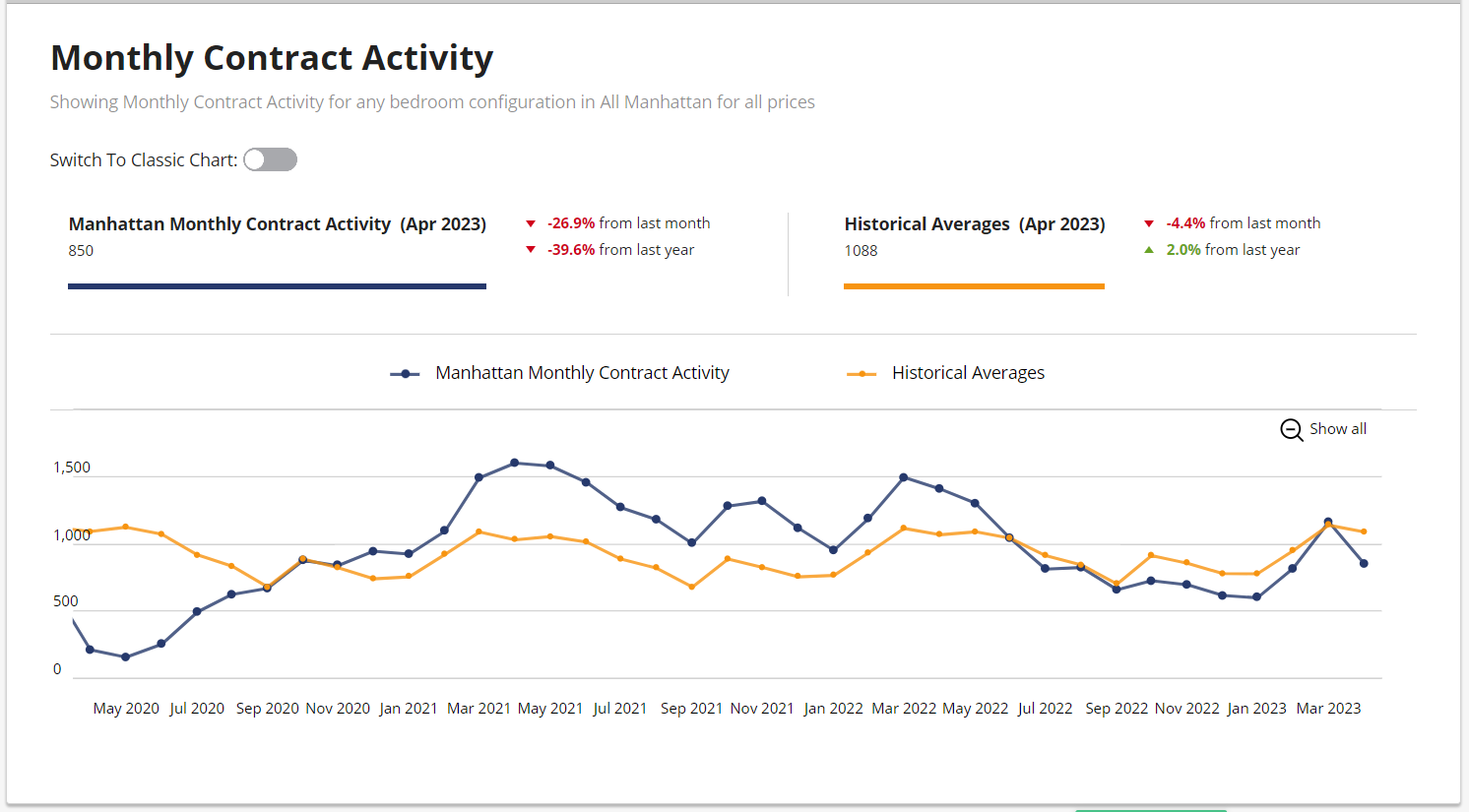

Monthly Contract Activity

Monthly Contract Activity resides at 850 (blue bar). The blue bar has fallen below the historical average of 1088 (gold bar) and is in a range-bound market path.

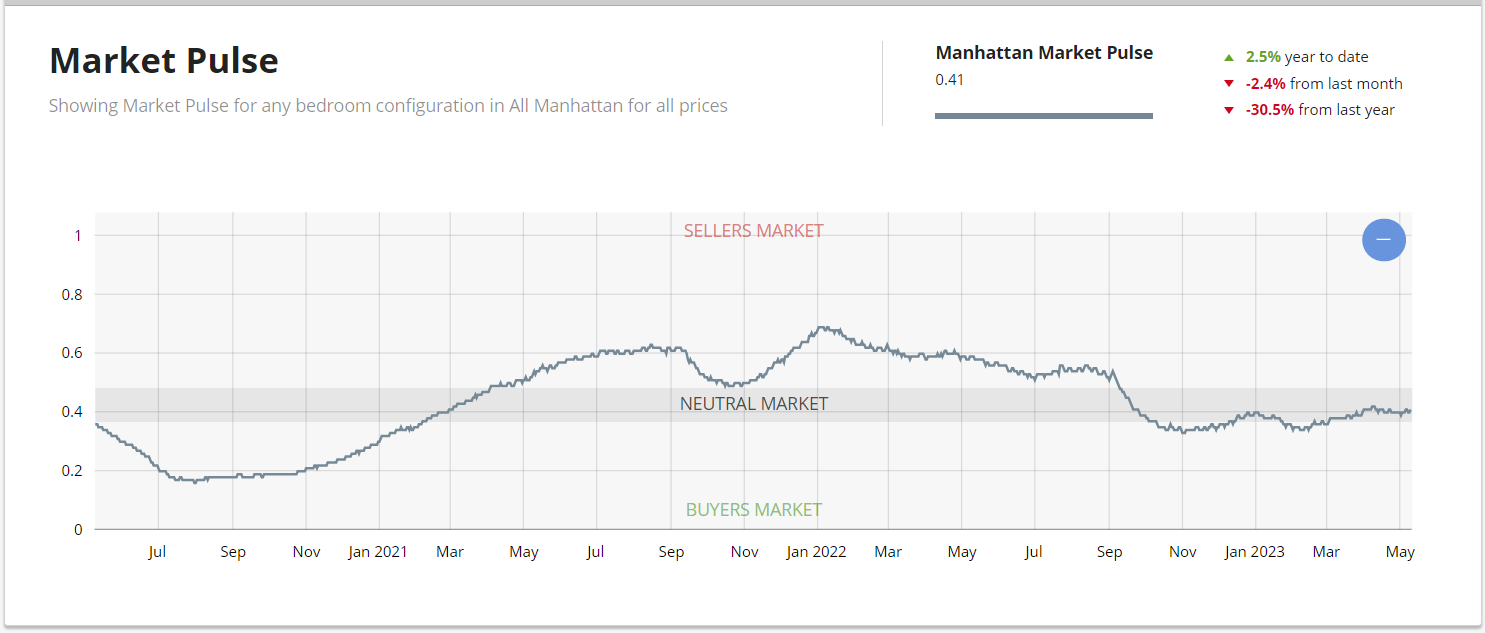

Market Pulse

The market pulse measures the ratio of supply and demand seems to continue to evidence the beginning of the buy-side leverage peaking. The market pulse is residing in Neutral Territory – .4%. In the UrbanDigs Market Pulse, the Manhattan Pending Sales to Supply ratio is .41% (Leverage is going toward the sell side). 2,803 Contacts are waiting to close. In Manhattan, price discovery takes 4-6 months.

The weekly supply resides at “494”; up 17%. The weekly contract resides at “234”. Off Market is higher than recently and stands at 196 listings.

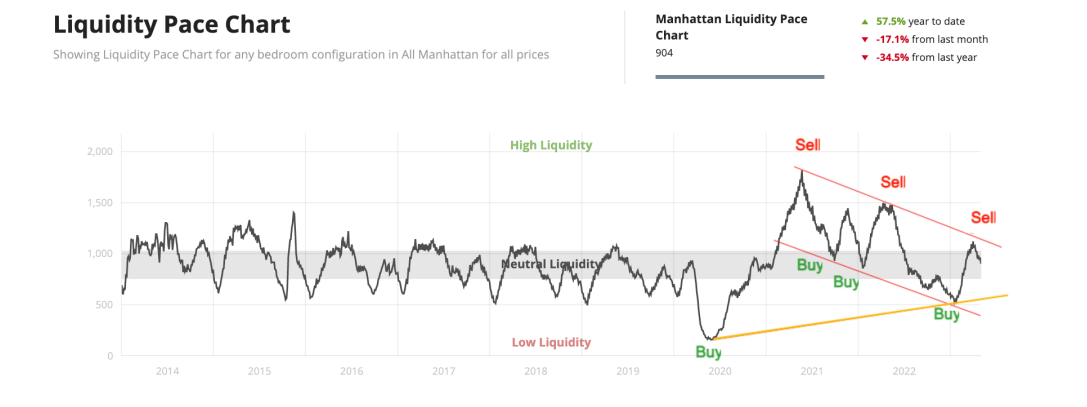

Liquidity Pace

The liquidity charge shows the total deal signed over the last 30 days and is a real-time measure of market action. We are in the peak selling market and we are witnessing signs that the market may be beginning to stall.

Source: Urbandigs

New Development

“After a couple of weeks of historically normal demand, the market revved up again this week as buyers signed 70 contracts. This is the 15th consecutive week where deal volume was above the pre-pandemic 2015-2019 average* of 53 contracts.”

– Kael Goodman, co-founder and CEO of Market Proof

Thirty contracts were signed last week in Manhattan at $4 million and above for the first week of May (1st through 7th, 2023). Three more contracts were signed than the previous week. Last week marked the seventh time this year that 30 or more contracts were signed. Although a healthy statistic in comparison to 2021, 30 or more contracts were signed 14 times.

Condos – 20 | Coops – 7 | Condop – 1 | Townhouses 2

Top 3 Contracts Signed:

- 33 Perry Street – Townhouse | Asking $16.9 million

- 810 Fifth Avenue – Unit 2 | Asking 16.5 million

- 150 Charles Street – Unit 14A | Asking $15.5 million

Total Weekly Asking Price Sales Volume $262,455,000 | Average Asking Price $7,719,265 | Median Asking Price: $6,200,000 | Average Discount from Original Ask to last Asking Price: 11% | Average Days on Market: 465

Demand Revs Up Once Again

“Contract volume increased this week, from 55 to 70 contracts, as did the average price from $2.3M to $2.5M. Those metrics pulled total dollar volume up with them, from $127M to $176M. The average PPSF was 11% higher at $1,853.

The $4M+ luxury sector posted its strongest week in months, with 15 contracts compared to the pre-pandemic average of 8.

Of the 70 contracts signed this week, 28 (–7%) were in Manhattan, 37 (+68%) were in Brooklyn, and 5 (+67%) were in Queens.” – Market Proof

Manhattan Reports 28 Contracts Totaling $130M

Although contract volume slipped from 30 to 28 signed deals, total dollar volume was up from $104M to $130M because the average price rose 33% to $4.6M. Average PPSF also grew 19% to $2,523.

Top selling developments this week are 200 Amsterdam Avenue with four contracts signed and One High Line with three contracts signed.