What are your homebuying goals, and have you been saving to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve your goals by paying for some of these expenses.

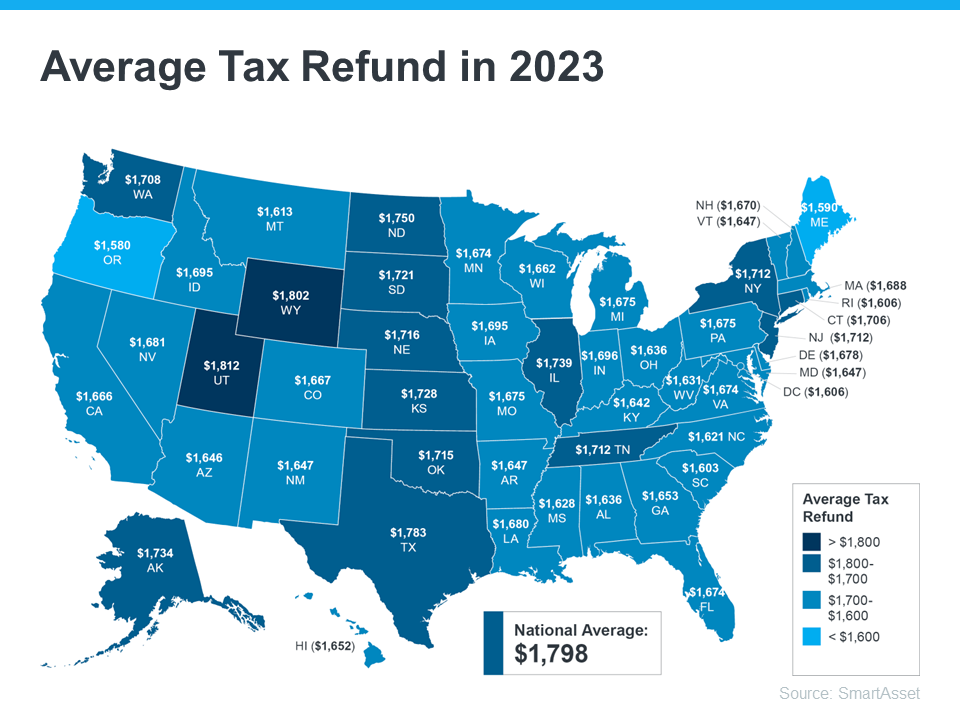

SmartAsset estimates the average American will receive a $1,798 tax refund this year. The map below provides a more detailed estimate by state:

According to Freddie Mac, your refund check can help you as a homebuyer in multiple ways. If you’re getting a refund this year and thinking about buying a home, here are a few tips to keep:

- Saving for a down payment – One of the most significant barriers to homeownership is saving for a down payment. You could reach your savings goal faster than expected by using your tax refund to help with your down payment.

- Paying for closing costs – You must pay fees to your lender, real estate agent, and other parties involved in the homebuying transaction before officially taking ownership of your home. You could direct your tax refund toward these closing costs.

- Lowering your interest rate – Your lender might allow you to buy down your mortgage interest rate during home-buying. That means you could pay a lower interest rate on your fixed-rate mortgage upfront.

The best way to prepare to buy a home is to work with a trusted real estate professional who understands the process. They’ll help you navigate the costs you may encounter as you begin your homebuying journey.

Key Takeaway

Your tax refund can help you reach your goals of homeownership. Let’s connect to discuss how you can start your journey today.