One of the benefits of being a homeowner is that you build equity over time. Those savings can be used toward purchasing your next home by selling your house. But before you can put it to use, you should understand precisely what equity is and how it grows. Bankrate explains it like this:

Home Equity

“A the portion of your home you’ve paid off – in other words, your stake in the property as opposed to the lender’s. In practical terms, home equity is the appraised value of your home minus any outstanding mortgage and loan balances.”

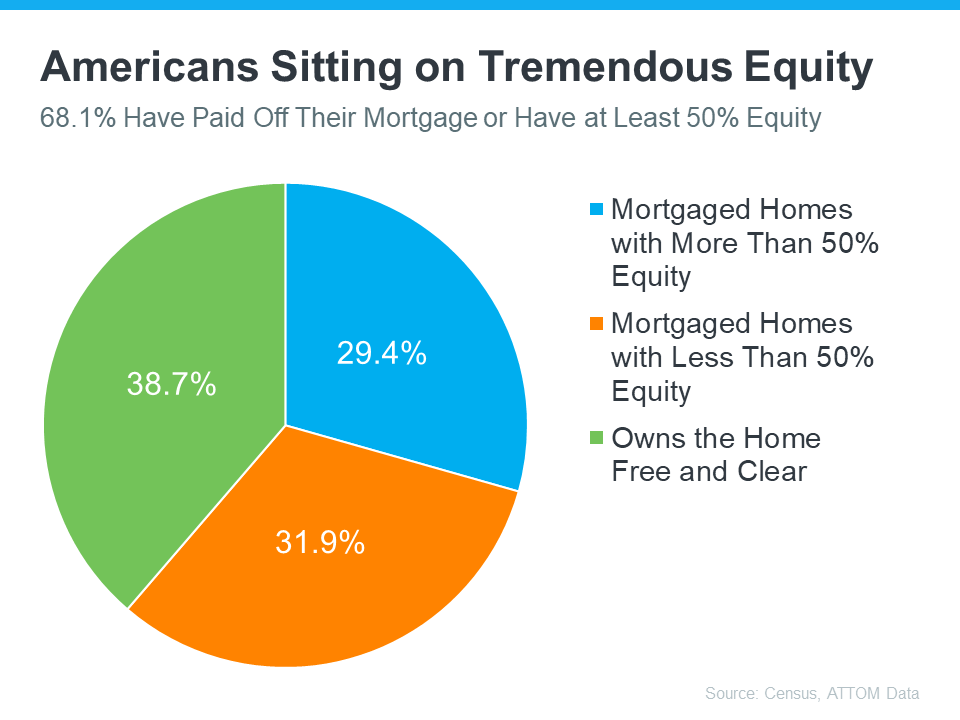

The majority of Americans Have Savings Stored in The Value of Their Home

If you’ve owned your home for a while, you’ve likely built up some equity – and you may not even realize how much. Based on data from the U.S. Census Bureau and ATTOM, the majority of Americans have a substantial amount of savings built up within their home right now (see graph below):

And having such large amounts of “valuable savings locked in from your home” benefits homeowners in more ways than one. Rick Sharga, Executive Vice President of Market Intelligence at ATTOM, explains:

“Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash like the one we saw in 2008.”

Over time, your home equity grows. In addition to providing financial stability while you own your house, when you’re ready to sell it, that money could go a long way toward paying for your next home.

Key Takeaway

Selling your house and leveraging savings stored in your home will make purchasing your next home more manageable. Let’s connect today so you can find out how much home equity you have and start planning your next move.