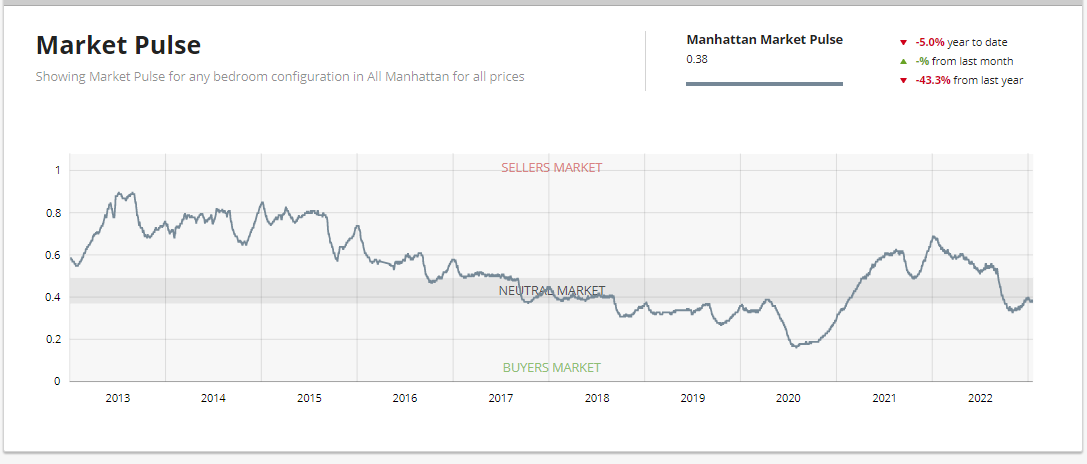

Manhattan Market Report for the week ending January 13th, Supply closed out at 5,839 and trending downward as we close out the year. Pending Sales at 2,256 and off-market listings (delisting) maintain the market pulse at a .38% level. Manhattan is holding on to price action due to the resilient rental market. With low supply in the sales market, sellers with built-in equity choose to rent or remove the listing from the market rather than reduce the sales price.

The labor market has begun to recalibrate, and companies like Microsoft, Amazon, Goldman, and other tech and finance companies have announced layoffs, disappointing bonuses, and/or hiring freezes. These companies are laying off 10% or more in the coming year. Additionally, wage gains are cooling too.

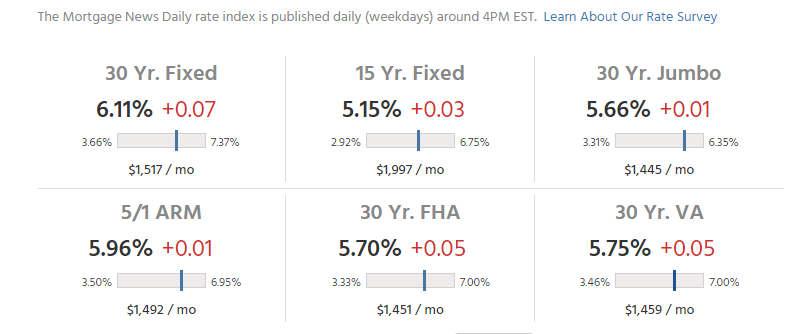

The Fed continues small interest rate hikes to tame inflation, and how congress addresses the debt ceiling remains unknown.

Market Pulse

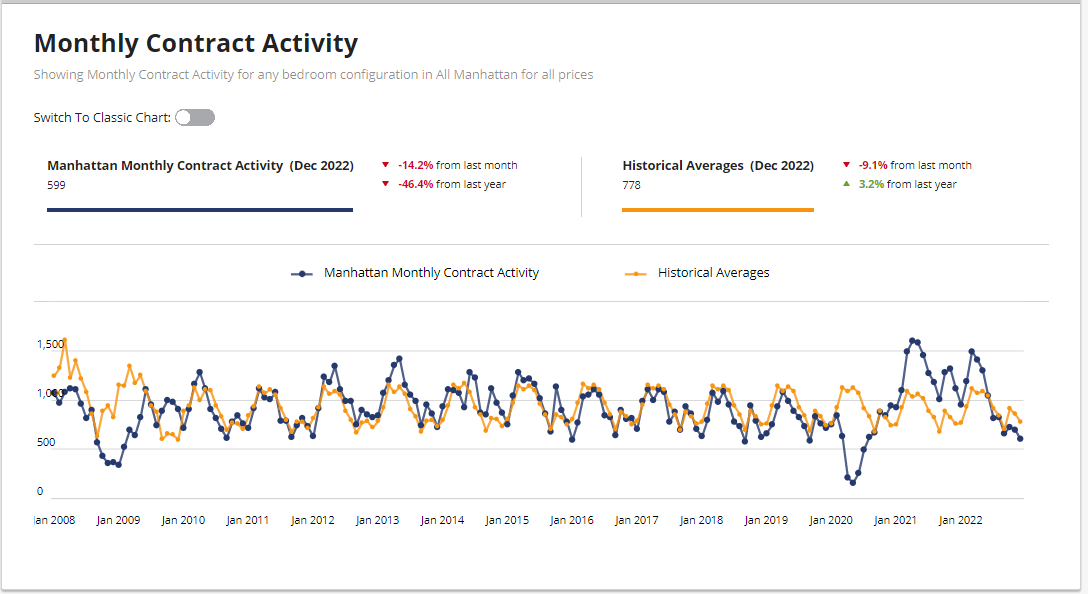

Monthly Contract Activity

Mortgage Rates

As inflation continues to moderate, mortgage rates declined again this week. Rates are at their lowest level since September of last year, boosting both homebuyer demand and homebuilder sentiment. Declining rates are providing a much-needed boost to the housing market, but the supply of homes remains a persistent concern.

Luxury Market

“Compared to the pre-pandemic 2015-2019 benchmark introduced within our 2022 NYC NEW DEV MARKET REPORT, demand is trending lower than historical norms, but price metrics are higher. In other words, there are fewer buyers, but they are paying more per square foot. The luxury market, however, is business as usual.”