Second homes during the pandemic became popular because of the rise in work-from-home flexibility. That’s because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite places or with different home features. Keep in mind a luxury home isn’t only defined by price. In a recent article, Investopedia shares additional factors that push a home into this category: location, such as a home on the water or in a desirable city, and features, the things that make the home itself feel luxurious.

Luxury Home Marketing

A recent report from the Institute for Luxury Home Marketing (ILHM) explains just how much remote work impacted the demand for second and luxury homes:

“The unprecedented ten-fold increase towards remote work since the pandemic is an historic development that will continue to fuel second home demand for many years to come.”

But what if you bought a second home that you no longer use? If you’re now shifting back into the office or seeing your priorities and needs change, you may not utilize your second home as much. If so, it may be time to sell it.

And if you own what’s considered a luxury home, buyer demand for it may be even greater. In another report, the Institute for Luxury Home Marketing explains:

“. . . the last few years have left their legacy for the luxury market. While it might only represent a small percentage of the overall real estate market, luxury homeownership’s influence is growing. Not only has the purchase of homes valued over $1 million (a figure considered by the National Association of Realtors to be a benchmark for luxury) tripled from 2.6% to 6.5% since 2018, but demand for multiple luxury properties has soared over the last two years.

This phenomenal increase has been driven by a growing affluent demographic who consider owning a luxury property a necessity in their asset portfolio. All indications are that this trend is here to stay, albeit that demand is set to return to a more sustainable level.”

Focus Shifts Away from Primary Residences

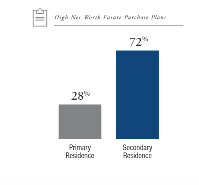

The Coldwell Banker “The Trend Report 2002” highlights “a shift toward building generational wealth by investing in multiple, lesser-priced, smaller homes. After all, we already know their affinity for real estate investment is high. Many appear to have their sights set on these types of property purchases over the next few years. According to our survey, only 28% of high-net-worth respondents planning a home purchase in the future said the new home would be a primary residence. Comparatively, 72 of those said that the new home would be either a second residence, rental property, or vacation home. Their focus on investment and second home ownership is notable, as these properties tend to be smaller and priced lower. They may not expect a quick return on their investment over the next few years, but that’s not the point of these purchases. Whether purchasing a rental property in a second-tier city as part of a retirement plan or a condo in a college town for their university-bound child, they have moved past the short-term lifestyle concerns of pandemic living. They have now adopted a long-term view of setting up their families for the future.

The work-from-home lifestyles were very relevant during the pandemic, but now that things are settling down, people want to go into the office again and change the environment. By owning multiple properties, they can feel like they have a little slice of home in various locations”.

Return to Work and Cities

At the height of the COVID -19 pandemic, people bought homes far from city centers, where they could get more space for less money. But now that life is returning to a pre-pandemic life. Companies require employees to return to the office, and having that extra square footage may seem less important.

Faced with longer commute times, many buyers may be looking for smaller homes closer to the city. Others are returning to urban life and purchasing townhomes and condos, which also have a smaller footprint. Demand has not only returned to pre-pandemic 2019 levels, but in many metropolitan locations, it has exceeded sales year-over-year.

Embracing change

Per Luxury Portfolio International, the sands are shifting back to major cities this year. Most luxury buyers plan to purchase property in a city center – 37 percent of primary home buyers and 47 percent of investment buyers, speaking to the city’s continued investment value.

All buyers reported that investment quality is their priority in a new property purchase.

Also, in 2023, there will be more investment buyers than primary home buyers – 33 and 31 percent, respectively. Perhaps due to economic swings, 66 percent of those surveyed said real estate is the best investment currently.

The hottest markets for international investors – more than half from the U.S. – are New York, Beijing, and Singapore.

Luxury buyers indeed have funds to invest. Global wealth increased 13 percent last year, and 80 percent of those surveyed said their financial stability had improved over the last three months.

Key Takeaway

If you own a luxury second home that isn’t being used as much anymore, now’s the time to sell. There are still buyers looking for a home like yours today.

Let’s connect to explore the benefits of selling your second home this year.

Other educational articles about the market and your home search are under Karen’s Blog.