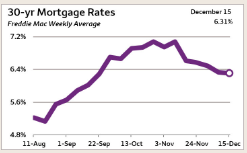

Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they’re dropping, and that has to do with everything happening in the economy.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains it well by saying:

“Mortgage rates dropped even further this week as two main factors affecting today’s mortgage market became more favorable. Inflation continued to ease while the Federal Reserve switched to a smaller interest rate hike. As a result, according to Freddie Mac, the 30-year fixed mortgage rate fell to 6.31% from 6.33% the previous week.”

So, what does that mean for your homeownership plans? As mortgage rates fluctuate, they impact your purchasing power by influencing the cost of buying a home. Even a small dip can help boost your purchasing power. Here’s how it works.

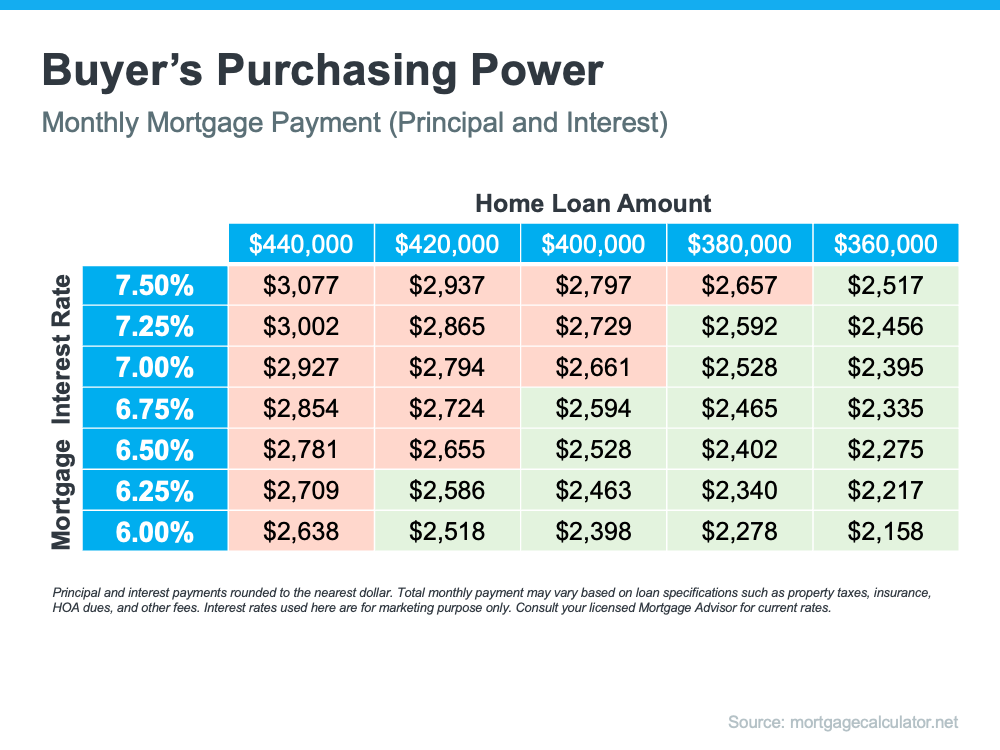

The median-priced home according to the National Association of Realtors (NAR) is $379,100. So, let’s assume you want to buy a $400,000 home. If you’re trying to shop at that price point and keep your monthly payment about $2,500-2,600 or below, here’s how your purchasing power can change as mortgage rates move up or down (see chart below). The red shows payments above that threshold and the green indicates a payment within your target range.

This goes to show, even a small quarter-point change in mortgage rates can impact your monthly mortgage payment. That’s why it’s important to work with a trusted real estate professional who follows what the experts are projecting for mortgage rates for the days, months, and years ahead.

Key Takeaway

Mortgage rates are likely to fluctuate depending on what happens with inflation moving forward, but they have dropped slightly in recent weeks. If a 7% rate was too high for you, it may be time to contact a lender to see if the current rate is more in line with your goal for a monthly housing expense.

This week, mortgage rates dropped for the fifth week in a row. Sure, they are still high at an average of about 6.31% for a 30-year fixed-rate mortgage. And that is only for the best-qualified borrowers with a 20% down payment. But that is what experienced investors tend to be.

Mortgage rates have been climbing all through 2022, hitting a peak at just above 7%. The real estate industry, just like Wall Street, builds in expectations of what the economy is going to do over the next 3 to 6 months. The sharp interest rate increases that the Federal Reserve has instituted this year were already built into mortgage rates at above 7%. With five straight weeks of drops in the mortgage rate, the industry is now building in what it expects to happen 3 to 6 months in the future.

Housing Updates

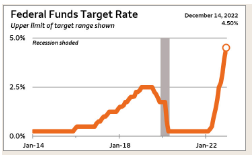

Federal Funds Target Rate

- On December 14, the Federal Reserve raised its short-term target rate range for the seventh time in 2022. The target range is now 4.25% to 4.50%, 50 basis points higher than the range set in early November. The target range began the year at 0.0% to 0.25%. 1

- Moreover, the Fed is expecting tighter monetary policy at year-end 2023 than it expected in September. At that point, the FOMC’s individual members’ projections for the midpoint of the fed funds target range ran from 3.9% to 4.9%. Now, just three months later, the projections for year-end 2023 run from 4.9% to 5.6%. In other words, what had been the highest projected rate three months ago is now the lowest expected rate. The median projection for the midpoint rate at year-end 2023 is 5.1%, or about three-quarters of a percentage point higher than it is today.2

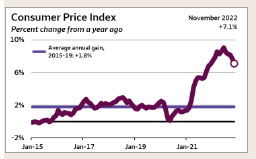

Consumer Price Index

- The Consumer Price Index rose 0.1% in November after rising 0.4% in each of the two prior months. Over the past year, the CPI is up 7.1%, a deceleration from October’s 7.7% increase and the slowest gain since the 7.0% gain in the year ending in December 2021. Consumers found some relief in energy prices in November, which fell for the fourth time in the last five months. Still, energy prices are up 13.0% over November 2021.3

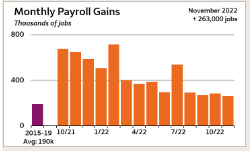

Monthly Payroll Gains

- Payroll employment gained 263,000 jobs in November, close to the increases of the three previous months. Payrolls had a monthly average of 190,200 new jobs during 2015-19. The unemployment rate remained at 3.7%. Over 2015-19, the unemployment rate averaged 4.4%.4

- Industrial production declined for the second consecutive month in November, slipping 0.2%. Over the past year, production rose 2.5%. Through the first 11 months of 2022, industrial production rose at a 3.0% annual rate. Through the first 11 months of 2021, industrial production rose at a 4.3% annual pace.5

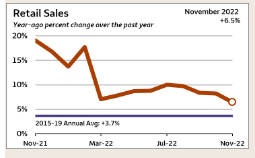

Retail Sales

- Retail sales fell 0.6% in November, its third monthly decline in the past five months. It generated a 6.5% gain over retail sales a year ago, the smallest year-ago gain since December 2020. The retail sales figures are not adjusted for inflation.6

30-Year Mortgage Rates

- The daily yield on the 10-year Treasury averaged 3.52% during the first trading days of December. It averaged 3.89% in November and 3.98% in October. The daily value for Wednesday, December 14, was 3.49%.7

- The average rate on 30-year fixed-rate mortgage applications submitted to Freddie Mac in the week ending December 15 edged down to 6.31%, two basis points below its average a week earlier. That’s its fifth consecutive week under 7.00%. The rate on the 30-year mortgage averaged 6.81% in November and 6.90% in October. Under a new methodology adopted last month, Freddie Mac no longer conducts a weekly survey but uses loan information submitted to its automated underwriting system. Additionally, Freddie Mac no longer collects fees and points.

Sources

- “Policy Tools: Open Market Operations,” Board of Governors of the Federal Reserve System, December 14, 2022. www.federalreserve.gov/monetarypolicy/openmarket.htm.

- “Federal Open Market Committee: Meeting calendars, statements, and minutes,” Board of Governors of the Federal Reserve System, Projection Materials from the December 2022 FOMC meeting. www.federalreserve.gov/monetarypolicy/fomccalendars.htm.

- “Consumer Price Index Summary,” Bureau of Labor Statistics, December 13, 2022. www.bls.gov/news.release/cpi.nr0.htm.

- “Employment Situation Summary,” Bureau of Labor Statistics, December 2, 2022. www.bls.gov/news.release/empsit.nr0.htm.

- “Industrial Production and Capacity Utilization,” Release G.17, Federal Reserve Board of Governors, December 15, 2022. www.federalreserve.gov/releases/g17/Current/default.htm.

- “Advance Monthly Retail Trade Report,” U.S. Census Bureau, December 15, 2022. www.census.gov/retail/index.html.

- “Daily Treasury Yield Curve Rates,” U.S. Department of Treasury, December 15, 2022. home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2022.

- “Mortgage Market Survey Archive,” Freddie Mac, December 15, 2022. www.freddiemac.com/pmms/.

Other educational articles about the market and your home search are under Karen’s Blog.