After a tepid August with everyone hanging out at the beach or their garden September fall season brought supply to the Manhattan Market. Finally, buyers have new inventory and aged inventory at new and improved prices to choose from.

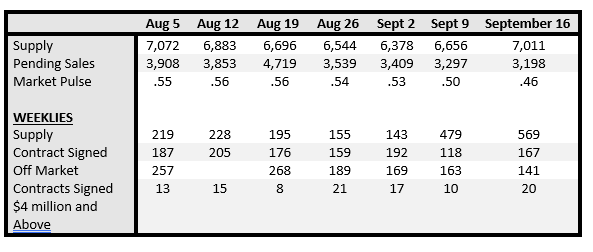

Inflation, world economic uncertainty, stock market woes, and interest rates quickly rising has impacted Contract activity. The market has shifted as reported by UrbanDigs:

- Deal Volume level – Contract Activity is down more than 50% from peak activity seen in spring and is currently hovering right at historical seasonal averages.

- Pricing Level – Early Q3 pricing data is showing the market is down about 2% on a price per sqft level and between 5% and 10% on a sales price level from the previous Q2 peak.

The reports you are reading in the news are based on old data. The market has shifted to a new, lower level. In 2021 and the first two quarters of 2022 the market was going over 100mph, and now we are going the normal speed limit of 60mph. The relative slowdown makes the market feel “slower” than it is, but it is still chugging along. The sales pipeline will likely continue to show declining prices until early 2023.

Contract Activity Lags

There is a chance we lag in contract activity for the near term given the recent volatility with interest rates and other risk assets. The Fed’s four hikes so far in 2022 have increased rates by a combined 2.25 percentage points — which means consumers are now paying an extra $225 in interest on every $10,000 in debt. Another 0.75% increase on Wednesday would bring that increase to 3 percentage points, or $300 in interest on every $10,000 in debt.

“It’s widely expected that the Fed will implement another rate hike of 0.75% when the Federal Open Market Committee meets tomorrow. Beyond that, more rate hikes are likely if the rate of inflation is still not under control.” And the stock market due to several risk factors is volatile. Closed market data indicators are lagging. Therefore, it will take a while to determine if we remain in the historical range or will have a new wave down.

New Development Sponsor Activity

Kael Goodman, co-founder, and CEO of Market Proof reported “new development contract volume is soaring in September. If last week is a bell weather for how the rest of the month unfolds, we could be heading into a very active fall season – especially if resale inventory remains low.”

New development condo contracts increased 54% from early September with 60 sponsor deals reported city-wide. Nine of those contracts were $4M compared with the week before, showing momentum building in the luxury tier as well.

Seller’s Take Note of the Shifting Market

As evidenced by the off-market listings, there are sellers who have chosen not to sell in this market as prices and buyers’ exuberance has faded. Some sellers have chosen to take advantage of the rental market’s 2% vacancy rate and become a landlord instead. Those sellers who must sell take advantage of this 2-4 week fall market window and price competitively.

Also, an urban myth to consider is: “If I sell my property for less than I paid for it, I am losing money”. Not necessarily. The all-important issue when selling relates not to the absolute price, but to your next step. If you are selling to buy a bigger place, a lower price can, oddly enough, work in your favor. If you bought for $1,500,000 but you are selling for $1,350,000, that means the market is down 10%. So, the property for which you would have paid $2,000,000 is now going to sell for $1,800,000. You end up with $50,000 ahead. It is always better to trade up in a down market; it saves you money. When you are selling and buying in the same market, all that matters is the difference in price between the two transactions. The absolute numbers (tax considerations aside) are irrelevant.

Buyers Ignore the Noise

Buyers, there is a lot of noise in the papers and social networks that do not apply to your special situation. The market survived the pandemic and will continue to thrive in the long run. Markets are not linear on the way up or the way down. All markets have their ups and down and you can not time the market perfectly. Buyers you currently have some leverage, but it may be short-lived since inventory remains tight and prices are holding.